Corporate Restructuring: A Guide to Business Transformation

Corporate restructuring is when you strategically redesign your company’s operational, financial, and legal frameworks to boost performance and sustainability. You’ll typically go through distinct phases including assessment, implementation, rebuilding, and monitoring, with each phase focusing on specific objectives like cost reduction, process improvement, or debt management. The main types include financial restructuring (debt reorganization), operational restructuring (business process changes), and equity restructuring (share modifications). Your benefits can include streamlined operations, enhanced market position, improved financial metrics, and stronger competitive advantages. Understanding the key components will help you navigate this complex transformation successfully.

What Defines Corporate Restructuring

Corporate restructuring involves three fundamental aspects: redesigning a company’s operational framework, adjusting its legal structure, and realigning its financial setup. When you’re faced with the need to restructure, you’ll find that it’s a thorough process that touches every part of your organization, from daily operations to financial implications and organizational culture changes. A primary goal is to achieve a lower debt-to-equity ratio to ensure long-term financial stability.

The process often requires you to work with financial and legal advisors who’ll guide you through complex negotiations with creditors, potential buyers, or merger partners. During restructuring, newly appointed CEOs often lead these challenging initiatives to save or reposition the organization. Whether you’re dealing with declining profits or seeking to streamline operations, restructuring provides tools to address these challenges head-on.

You’ll typically encounter restructuring when your company needs to adapt to significant changes, such as excessive debt, industry shifts, or new leadership direction.

The outcome of restructuring can transform your company’s future through debt reduction, improved efficiency, and strategic realignment. You might find yourself implementing changes like selling underperforming units, renegotiating debt terms, or modifying your management structure to better position your organization for long-term success and sustainability.

Different Types of Restructuring

The landscape of restructuring encompasses four main categories that businesses can utilize to regain their footing or accelerate growth: financial, equity-based, operational, and hybrid restructuring.

When you’re facing financial challenges, debt reprofiling through strategies like refinancing or debt-for-equity swaps can provide breathing room. Your company might benefit from equity-based restructuring through rights offerings or strategic share buybacks, which can strengthen your capital structure and align shareholder interests. Some companies opt for a prepackaged bankruptcy approach to expedite the restructuring process while maintaining operations. Investment banks serve as expert advisors throughout the restructuring journey.

In operational restructuring, you’ll find opportunities through asset divestment, strategic alliances, or organizational changes that enhance efficiency and market position.

For thorough transformation, hybrid restructuring combines multiple approaches. You might implement a turnaround strategy that addresses both financial and operational aspects, or pursue cost restructuring alongside strategic repositioning. Each type serves different needs: financial restructuring tackles debt burdens, equity-based restructuring optimizes ownership structure, operational restructuring improves business performance, and holistic approaches offer comprehensive solutions. The key is selecting the approach that best matches your company’s specific challenges and goals.

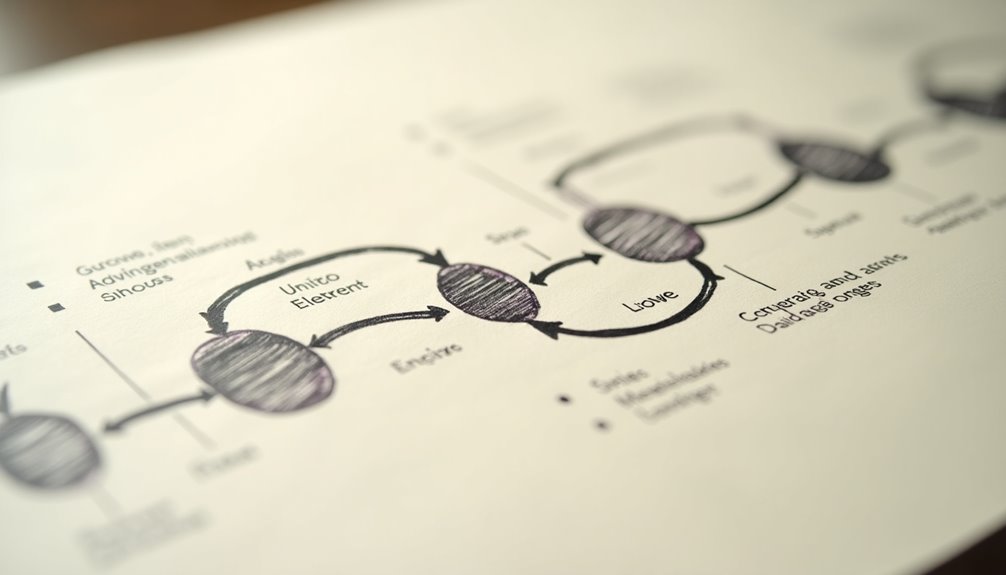

Key Phases and Timeline

Successful restructuring initiatives unfold across four distinct phases that typically span 12-18 months. Your restructuring timeline should begin with a thorough assessment phase, where you’ll evaluate your organization’s current state and set clear objectives. Engaging key decision-makers and stakeholders during assessment helps ensure buy-in and comprehensive planning. During this initial stage, cost reduction goals are typically established to guide the restructuring efforts.

During the implementation phase, you’ll need to carefully manage the restructuring implementation process, including communicating changes to stakeholders and beginning the transformation.

The rebuilding phase is where you’ll start seeing your plans take shape. Here’s what you should focus on during this critical period:

- Implementing new organizational structures and reporting lines

- Training teams on updated processes and technologies

- Establishing revised operational workflows

- Monitoring employee adaptation and addressing concerns

- Measuring early performance indicators

The final monitoring phase is essential for ensuring long-term success. You’ll need to track progress through regular assessments, gather feedback from stakeholders, and make necessary adjustments. Remember that while the initial restructuring implementation may take 12-18 months, you’ll continue to refine and optimize your new organizational structure beyond this period to maintain effectiveness and adapt to changing business conditions.

Advantages for Business Growth

Strategic business restructuring delivers powerful growth advantages that can transform your company’s market position and financial health. When you implement restructuring effectively, you’ll gain improved market positioning through streamlined operations, enhanced operational agility, and stronger financial performance that puts you ahead of competitors. Through effective mergers and acquisitions, you can achieve expanded market reach and accelerate growth. Establishing a restructuring committee helps identify key leaders to drive successful transformation forward.

You’ll find that restructuring opens doors to valuable growth opportunities through strategic initiatives like joint ventures and market diversification. By optimizing your workforce and eliminating redundant processes, you’ll achieve better operational efficiency and reduced costs, leading to higher EBITDA margins and earnings per share. Your company will be better equipped to adapt to changing market conditions, regulatory requirements, and technological advances.

The financial benefits you’ll realize include strengthened cash flow, reduced debt burden, and improved overall stability. Through economies of scale, you can lower unit costs while increasing production volume, creating sustainable competitive advantages. By focusing on core business segments and divesting non-productive assets, you’ll create greater shareholder value while positioning your company for long-term success in an ever-evolving marketplace.

Parent Company Impact

Parent company performance undergoes significant shifts during corporate restructuring initiatives, with impacts rippling across multiple financial metrics and operational areas. You’ll notice these changes reflect in shareholder dividend changes and executive compensation modifications, as the company adapts its financial structure to new realities. Creating clear bullet point lists helps stakeholders better understand these organizational changes.

The impact on your parent company will vary depending on the restructuring approach chosen, but you can expect to see several key effects:

- EBITDA margins typically fluctuate during mergers and acquisitions before stabilizing at improved levels

- Interest Coverage Ratio strengthens with debt reduction initiatives, enhancing your company’s financial stability

- Share buybacks can reduce your Weighted Average Cost of Capital while boosting Earnings Per Share

- Workforce reductions may temporarily impact productivity but often lead to improved long-term efficiency

- Spin-offs can reshape your revenue streams and allow for more focused strategic growth

When managing these changes, you’ll want to monitor both immediate and long-term effects on financial health. The restructuring process often requires balancing short-term disruptions against long-term strategic benefits, particularly when considering shareholder dividend changes and executive compensation modifications that align with new corporate objectives.

Common Challenges and Risks

Beyond the impact on parent companies, corporate restructuring comes with significant hurdles you’ll need to navigate. When you’re undertaking a leadership shift during restructuring, you’ll face challenges that can affect your company’s ROI and overall performance, particularly if your management team lacks experience with complex organizational changes. A vertical list format can help organize and communicate the various challenges effectively.

Stakeholder engagement becomes important as communication barriers and siloed teams can seriously impede your progress. Your employees might resist change, while shareholders may question your strategies, making it essential to maintain clear, consistent communication throughout the process. The loss of team momentum often results from ineffective communication between key stakeholders during the transition period. Additionally, you’ll need to carefully manage the legal and regulatory landscape, which includes compliance requirements, foreclosure standards, and foreign investment rules that could impact your restructuring efforts.

Financial constraints often present another major challenge you’ll need to address. With rising interest rates affecting debt refinancing and limited access to funding sources, you’ll need to develop a robust financial plan that considers various funding options, potential debt-equity conversions, and strategic asset sales to confirm your restructuring initiative’s success.

Success Stories and Case Studies

Through the lens of successful corporate turnarounds, you’ll find compelling evidence that well-executed restructuring can breathe new life into struggling organizations. Some of the most remarkable transformations have occurred when companies embraced strategic leadership and customer focused innovation to overcome their challenges.

These transformations often require committed leadership teams to drive the necessary changes forward. A thorough SWOT analysis helps identify key areas requiring immediate attention. Consider these notable success stories that demonstrate effective restructuring strategies:

- General Motors emerged from bankruptcy through all-encompassing financial restructuring, government collaboration, and radical operational changes

- IBM transformed from a product-centric to a customer-focused organization, investing heavily in R&D while reducing debt

- Nokia successfully pivoted to network equipment and digital health markets, demonstrating remarkable adaptability

- Starbucks regained market dominance by revamping leadership and operational practices

- Lego innovated its product offerings and diversified its portfolio, recovering from near-collapse

You’ll notice that these companies share common elements in their turnaround strategies: they all implemented decisive leadership changes, maintained clear stakeholder communication, and prioritized customer needs. Their successes weren’t accidental but resulted from carefully planned restructuring efforts that balanced financial stability with operational improvements.

Best Practices and Implementation

When implementing corporate restructuring, success hinges on following established best practices and maintaining a systematic approach to change. You’ll want to start by thoroughly analyzing your current structure and defining clear objectives that align with your organization’s goals, such as improving cash flow or increasing operational efficiency. Establishing the proper legal entity structure is crucial for protecting assets and optimizing tax benefits.

Effective stakeholder engagement is pivotal throughout the process, so you’ll need to involve senior management, employees, and investors from the beginning. Your change management strategies should include a phased implementation approach, transparent communication channels, and extensive training programs for affected staff. Consider establishing a dedicated change management team to oversee the shift and monitor progress. Regular town hall meetings can help maintain open dialogue and address employee concerns in real-time.

As you move forward, you’ll need to guarantee legal compliance, develop new organizational guidelines, and provide support services for any displaced employees. Don’t forget to regularly evaluate the restructuring’s impact and make necessary adjustments to stay on track. Remember to maintain clear communication throughout the process and focus on strengthening your organizational culture once the changes are implemented. This systematic approach will help you navigate the complexities of restructuring while maintaining team cohesion and productivity.

Frequently Asked Questions

How Do Employees Maintain Work-Life Balance During Intense Restructuring Periods?

You can maintain balance during intense periods by utilizing work from home strategies, which allow you to better manage personal commitments while meeting professional demands.

Focus on establishing open communication channels with your supervisor to discuss workload concerns, set boundaries, and request flexibility when needed. Consider creating dedicated workspace at home, scheduling regular breaks, and maintaining consistent work hours to separate professional and personal life.

What Personality Traits Should Restructuring Leaders Possess to Effectively Manage Change?

Like a captain steering through stormy seas, you’ll need emotional intelligence to navigate your team’s concerns and feelings during times of alteration.

As a leader, you should possess decisiveness to make tough calls quickly, adaptability to handle unexpected challenges, and strong communication skills to maintain transparency. You’ll also want to demonstrate resilience, integrity, and strategic thinking to build trust and guide your team through shifts effectively.

Can Small Businesses Benefit From Restructuring, or Is It Primarily for Corporations?

Yes, you can absolutely benefit from restructuring as a small business owner. While corporations often make headlines with major overhauls, small businesses can achieve significant improvements through targeted restructuring efforts.

You’ll see benefits in cash flow management, operational efficiency, and debt reduction. Consider starting with simple changes like reorganizing workflows, renegotiating vendor terms, or streamlining processes – these adjustments can make a meaningful difference in your business’s performance.

How Do Competitors Typically React to News of a Company’s Restructuring Plans?

As the saying goes, “When one domino falls, others follow.” You’ll find that competitors typically react to restructuring news in calculated ways, watching for market share implications and customer loyalty impacts.

They’ll often respond by analyzing their own operations, potentially matching cost-cutting measures, or seizing opportunities to attract uncertain customers. Some may even accelerate their own transformation plans to maintain competitive positioning, while others might choose to wait and observe the outcomes.

Are There Seasonal or Economic Timing Factors That Affect Restructuring Success Rates?

Yes, your restructuring success can be considerably influenced by both seasonal and economic timing factors. You’ll generally find better outcomes when market influences are stable and positive, typically during Q2 and Q3.

Industry trends show that restructuring during economic upswings often yields higher success rates, while attempting major changes during holiday seasons or economic downturns can create additional challenges, including employee resistance and financial strain.

Final Thoughts

Like a skilled architect transforming a blueprint into reality, you’re now equipped to navigate corporate restructuring with confidence. You’ve learned how mergers, acquisitions, and reorganizations can reshape your company’s foundation, creating stronger pillars for growth. While challenges may arise like storm clouds on the horizon, your understanding of best practices and strategic planning will help you weather any difficulties and emerge with a more robust, profitable organization.