Phew! The week of Dec. 9 was very busy for me – a lot of stuff happened.

First, I attended a big Freemason event at my lodge back in the U.K. Contribution and community are two major areas of focus for me. Through Freemasonry I’m able to support charities and do good work inside my community.

We also had the general election in the U.K. termed the “Brexit election.” It was a major deal.

Thanks to the largest turnout in years, Boris Johnson and the Conservative Party won with a huge majority, meaning Brexit will now happen on Jan. 31, 2020.

This is a massive deal for buying businesses in the U.K… in a positive way.

Small-business owners don’t like uncertainty. You will see many more businesses come to market in early 2020 and strengthen what is already a buyer’s market.

Thanks to the excess supply, I predict company valuations will be driven down and sellers will be more inclined to accept seller financing terms – the key for any leveraged buyout (LBO).

By my estimation, there are more than 430,000 businesses for sale in the U.K. Only a fraction will sell in the next 12 months, making for lots of opportunities in virtually all sectors.

Despite Brexit, in reality nothing will change with these businesses. They will still sell their products and services. The U.K. is free to negotiate trade deals directly with major global economies.

So even if your target business is exports, 1) it’s going to take years for Brexit to properly transition and 2) you may well see increased trade opportunities.

Brexit is a psychological blow for small-business owners, and that’s only good news for us as dealmakers. Remember, small LBO deals are 90% psychology and 10% numbers.

We’re playing a game of psychology and relationships. I also signed the contract for my new U.K. house last week. Our dream house came on the market and we snapped it up.

My family and I will move into it in late January.

Our dream house in the English countryside

I’ve used this analogy many times before, but buying a business is very similar to buying a house. The transaction is virtually identical.

You do your research and find opportunities…

You make an offer…

You raise financing…

And then in both cases you complete your due diligence and close via a legal process.

There is, however, one major difference between buying a house and a business… valuation.

The valuation of a house is typically driven by comparable houses in the area. So a house in San Francisco will be worth 10—100 times as much as the same house in Idaho (no disrespect to the fine people of Idaho. It just is.)

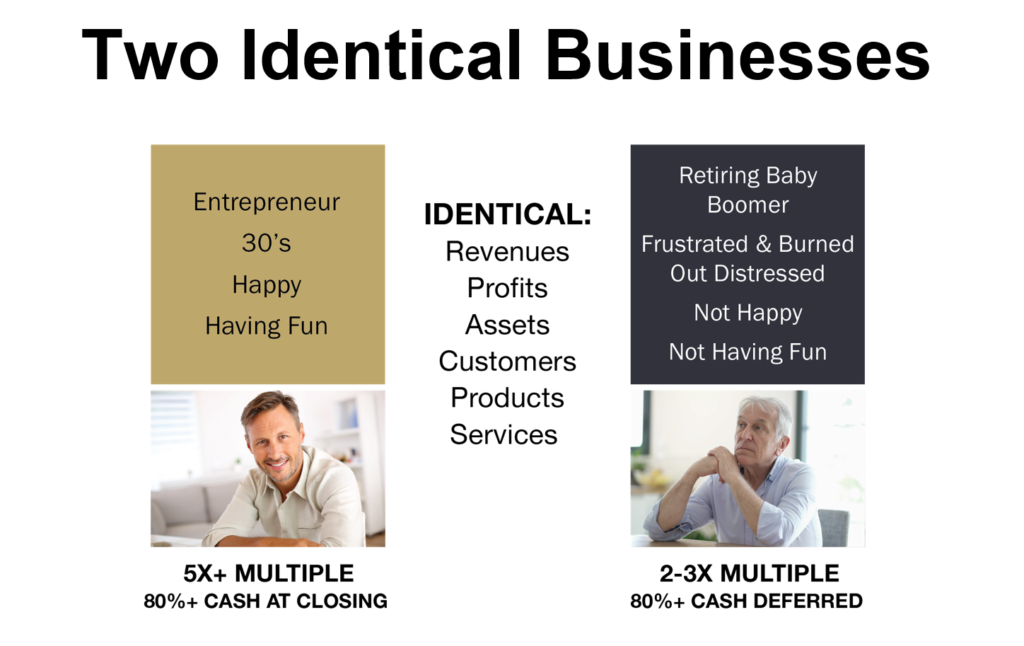

When you are buying a business, the main thing that drives valuation is the psychology of the seller.

If the seller (not the business) is distressed and highly motivated to exit, then the valuation will be lower and you can pay for much (or all) of it over time through seller financing.

If the seller is not motivated to exit (think of a 30-year-old entrepreneur having fun), then the valuation will be higher and you will need to pay most of the money at closing.

The rest of December I’ll be back and forth multiple times between the U.K. and Baltimore – where I’ll be for New Year’s Eve! – so I’m sure to have some great stories to tell come the new year…

In addition to the official transition of Ninja Acquisitions to Dealmaker Wealth Society.

So be sure to have a safe and joyous New Year’s Eve!

Until then, bye for now.

Carl Allen

Editor and co-founder, Dealmaker Wealth Society