So – you’ve identified a business you want to buy.

You’ve run through the company’s financials… and everything looks fine. You’ve met with the seller… and hit it off great. You’ve structured a deal you feel good about… and negotiations are humming along nicely.

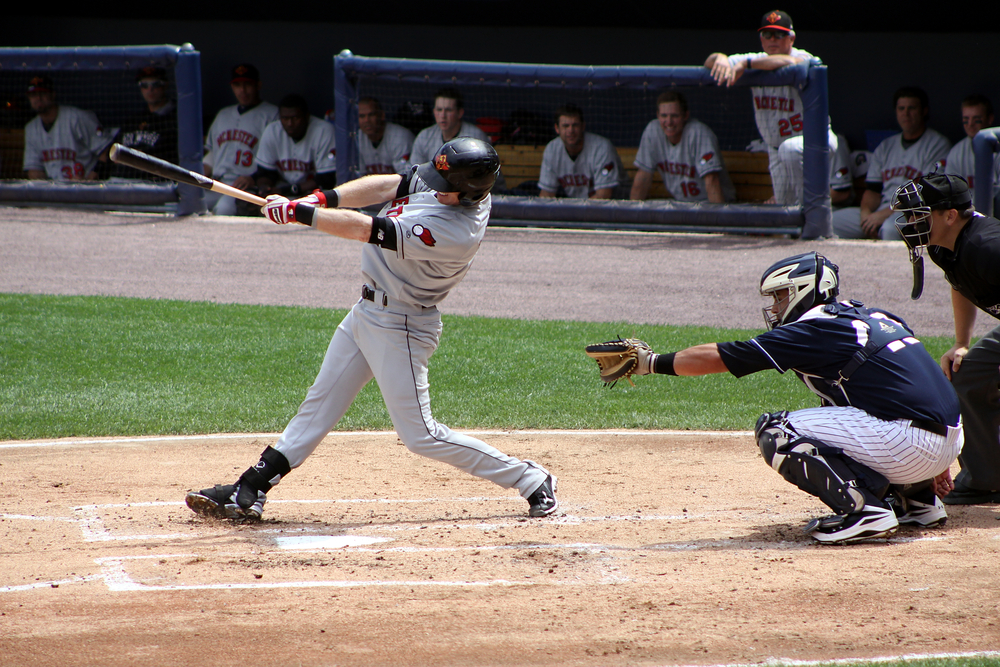

Then, suddenly, the seller throws you a curveball.

Maybe the seller decides they want to keep the receivables. Or they refuse to indemnify you against liability claims. Or any number of other hiccups…

What can you do?

The most important thing you MUST do during negotiations is maintain the positive relationship and excellent rapport you built through the process so far.

Remember, buying businesses is about relationships. Especially at the smaller end of the market where we operate (businesses with $1—5 million in annual revenue), deals are done between people – buyer and seller.

So – the stronger your…

The stronger your position as the safe pair of hands to take the business to the next level…

And the easier it is to negotiate, especially when deals hit a snag.

There isn’t a single deal I have ever worked on that didn’t hit at least one snag – usually during the due diligence process or legal discussions.

Here are a few of the most common bumps in the road you might encounter… and how to smooth them over to continue on your business-buying journey.

Receivables

Receivables are one of the critical assets in the business. You don’t want to buy a business without them.

Let’s say I wanted to buy a house, and then at the last minute the seller said, “Hey, Carl, good luck in the house, bro, but I’m taking the roof with me. You’ll have to build another one.”

Hard pass on that. I’m off to look for another house.

Even if I still wanted to buy the house, I would reduce my offer by the same amount to account for the missing roof.

You can do the same thing with a business.

If the seller is dead set on keeping the receivables (which means you can’t use them to finance the closing payment), you can still say yes… BUT be sure to reduce the closing payment by the same amount.

That’s because the seller will simply collect the receivables and turn them into cash. It’s an extra payment for them, which is why we adjust our closing payment if the seller wants the receivables.

Usually, if you negotiate using that language, the seller will quickly give them back.

Net Current Assets

Also called working capital, net current assets (NCA) are the capital used in day-to-day operations of the business. They are calculated as the current assets minus the current liabilities.

What some sellers will do, if you don’t watch out, is take all of the money out of the business before you buy it. So you end up with a business that has no money in it to trade.

It’s like if you agree to buy a house with all of the furniture in it. Then when you take ownership, you find there’s no bed to sleep in or refrigerator in the kitchen.

When signing a letter of intent (LOI), you MUST set a strong NCA position – i.e., the amount of working capital that is staying in the business at closing so you can continue to trade it comfortably.

This can turn into a bit of an arm-wrestling match. But the higher the bar you are able to set when it comes to your NCA position, the better off you’ll be when you actually buy the business.

I show you how to calculate this in my Dealmaker CEO training program. (I even give you a model to do it in less than five minutes.)

Warranties and Indemnities

Another curveball the seller can throw is in regard to warranties or indemnities.

A warranty is a promise or assurance something is as represented. It will always have a time limit, and a breach will incur financial penalties for the seller.

An indemnity is some sort of security or protection against financial loss or burden.

Even though your contingent-fee accountant and lawyer are doing due diligence on the business, you want those safety nets.

In the rare case the seller has failed to disclose something material, you should have an offset clause in the legal documents to deduct that from the seller financing.

I once acquired a technology company in Australia that manufactured shark deterrent devices used by sailors, surfers and scuba divers.

A major issue for me and partners was the seller refusing to indemnify us against product liability claims for units previously sold.

Look – if you are scuba diving the Great Barrier Reef and Jaws suddenly decides he’s hungry, you want to make sure your $1,000 deterrent device is going to work, right?

To be fair, sharks pretty much only attack humans by accident…

Luckily, the insurance liability company agreed to indemnify instead so we could close the deal without additional risk.

Change of Heart

Another last-minute issue could be seller remorse.

Remember, selling a business is one of the (if not the) most important and emotional decisions a business owner will make.

A person might think they’re ready, but people get emotional. And in rare cases, they just can’t give it up.

When that happens, play on your rapport.

Remind the seller WHY they need to sell. (This is the most important question you need to ask in the seller meeting.)

Remind them that YOU are the safe, trustworthy pair of hands they’ve been looking for to continue their legacy. And perhaps talk to them about staying on in a managerial or advisory capacity.

In the end if the deal still falls apart, go back to your deal origination funnel and start working on another opportunity.

After all, you’re only ever one deal away…

Until next time, bye for now.

Carl Allen

Editor and co-founder, Dealmaker Wealth Society

P.S. Learn how to set up a deal origination funnel that will pump out a stream of high-quality leads in the Dealmaker CEO training program. My proprietary course covers every step of your business-buying journey – from the first search to the final closing payment. Click here to enroll today.