There’s a big myth when it comes to buying a business.

That you need to have an MBA from a top business school…

Or a job on Wall Street…

Or a background in finance and a gigantic brain.

Well, that’s just not the case.

Yes, I do have a business degree from the University of Chicago Booth School of Business… And I spent years working for major financial institutions on and off Wall Street.

But even if I had done none of those things, I could still be where I am today – no higher math required.

Valuing a business is easy. And by easy I mean, it’s simple. Uncomplicated.

In fact, it’s the EASIEST part of buying a business.

Can you add? I’m sure you can… Subtract? Yep, that’s child’s play… Multiply by three? Of course.

Then you can value a business.

If you can value a business, you can structure a deal. And if you can structure a deal, you can make an offer. Which puts you one handshake away from buying your first business.

Let me prove it to you.

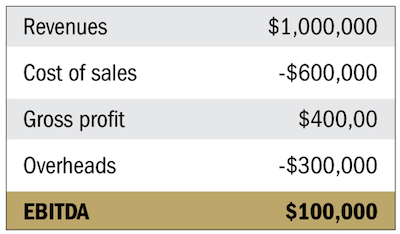

Here’s an income statement…

Remember, EBITDA – which stands for earnings before interest, taxes, amortization and depreciation – is essentially the operating profit of the business.

In the majority of cases, the value of a business is a multiple of EBITDA. For the types of deals we do at Dealmaker Wealth Society – small businesses generating $1—5 million in annual revenues – we’re looking for multiples of EBITDA averaging 2—3X.

This calculation is called enterprise value – or EV for short. This is the value of the trading operation – not including the value of shares or equity.

In some cases there are other factors to consider when calculating the EV, depending on the sector and a few other variables, which I will cover in future articles.

But for now, let’s say this is a great business. It’s growing, with some barriers to entry, solid processes and good employees and customers.

So let’s say we agree to pay 3X the EBITDA.

Well – 3 x $100,000 = an EV of $300,000.

Not exactly rocket science, is it?

Let’s keep going…

Now that we have the value of the business, let’s calculate the value of the equity, or the shares in the business.

All we have to do is add nonoperating assets (real estate being the biggest) and subtract the debt the business already has on its balance sheet (tax due, bank loans, mortgages on real estate, etc.).

So the value of the shares = EV (enterprise value) + RE (real estate) — debt (existing).

Our hypothetical deal comes with a piece of real estate (factory, office, etc.) that’s been valued at $200,000, and there’s $100,000 of debt inside the business.

This puts the share value at $400,000. Using the formula above, the value of the shares therefore equals $300,000 (EV) + $200,000 (RE) — $100,000 (DEBT), or $400,000.

Brain hurting yet? Of course not! Piece of cake.

And we’re almost there…

It’s time to structure the deal.

Assume there are $400,000 of assets in the business and we can raise $250,000 against them (including the real estate).

Say we want to keep $50,000 back for closing costs (contingent adviser fees, some working capital and perhaps a deal fee for us).

Now we have $200,000 to make a closing payment ($250,000 — $50,000), which leaves $200,000 of the $400,000 price tag left to make in payments over time.

This is called seller financing.

About 80% of sellers will accept SOME form of seller financing. The more motivated the seller, the more seller financing they’re likely to accept.

If this business is generating $100,000 in profits today, let’s commit to parting with 50%, or $50,000 per year, in seller financing payments.

We owe $200,000… which means at $50,000 per year we will pay the seller financing over four years. ($200,000/$50,000 = 4.) No Ph.D. required.

So here’s our offer…

Total purchase price to acquire 100% of the business (including shares and real estate) = $400,000.

$200,000 closing payment (raised against the assets in the business) + $200,000 in seller financing at $50,000 per year for four years.

Done.

And you can do all this – value a potential business, structure a deal and make an offer – with just the business’s balance sheet and a little bit of simple math.

Questions?

Reply to this email and I’ll cover your concerns in future Confessions.

Until then, bye for now.

Carl Allen

Editor and co-founder, Dealmaker Wealth Society