It started quietly a few months ago… a new force dominating news media.

No – it isn’t Bernie versus the DNC…

The threat of war…

Or weird weather events like wildfires in Australia or floods in Venice…

But panic is spreading… stocks are fluctuating wildly… and the fear has reached the highest levels of global consciousness.

Listen, I’m not a nervous person. Nor am I someone who panics. When others lose their heads, opportunities abound.

As the old saying goes, “Buy when there is blood in the streets.”

Which is what I’m telling you to do now.

Source: BBC News

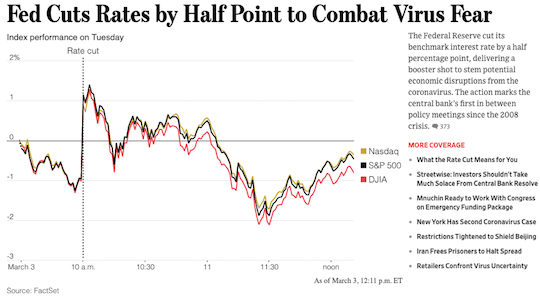

Just yesterday, the U.S. Federal Reserve cut interest rates by 50 basis points. Overall, the federal funds rate is now 1.25%.

This isn’t just a 50 basis point drop… It’s a drop of nearly 30%.

But there’s a silver lining…

This could be wildly beneficial to your business-buying pursuit.

I’ll show you how in a moment. Before I do, let’s talk about how unusual this is.

Source: WSJ.com

The Federal Reserve usually meets quarterly to determine any rate movements, which dictate the cost of capital for the central banking system.

Yesterday’s cut was not only out of the ordinary – occurring between meetings – but the Fed was hyperspecific as to why they made the cuts.

From The Wall Street Journal:

“We do recognize a rate cut will not reduce the rate of infection, it won’t fix a broken supply chain. We get that,” Mr. Powell said. “But we do believe that our action will provide a meaningful boost to the economy. More specifically, it will support accommodative financial conditions and avoid a tightening of financial conditions which can weigh on activity and will help boost household and business confidence.”

I’ll believe it when I see it.

Rates are now back down to a two-year low – with more cuts likely to come in the coming months.

So what does this mean for us dealmakers?

Blood in the streets presents an incredible opportunity for profit.

Why?

Because we acquire good, strong companies using leverage. Asset-backed loans, cash flow loans, SBA loans and beyond… We are a debt-generating machine!

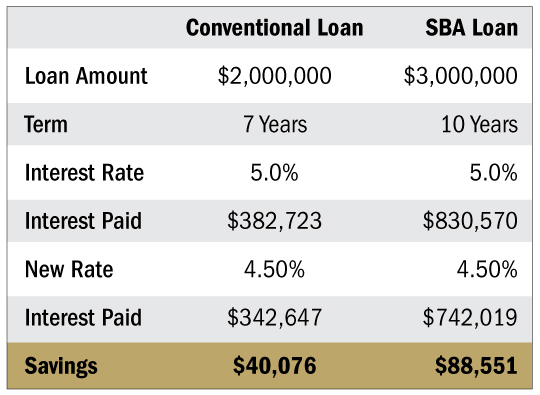

The reduction in the cost of capital from this rate cut will make a big difference – which will likely expand as rates continue to trend downward.

It isn’t unprecedented to expect further rate drops…

Yesterday was just 50 basis points. With pressure from the government, a possible pandemic and a flagging stock market, I expect further rate cuts to come.

As a buyer, this means massive savings.

Look at the two examples below:

That’s nearly $90K back in your pocket on an SBA loan. If rates drop further, you could see even more savings.

The Federal Reserve makes a snap decision – again, between meetings – and we as business buyers benefit immediately. Just like that – our cost of capital goes down.

I know this has only steeled my resolve to move as quickly as possible.

Right now, Carl and I have dozens of deals in the works through our private equity company. We’re not going to slow down changing the world – for ourselves or the partners we work with.

You shouldn’t either. Not while the getting is so good.

Build your network. Feed your origination pipeline. Unleash the power of Carl’s training.

Remember, you’re only one deal away.

You’re only one deal away,

Adam Markley

Co-founder and publisher, Dealmaker Wealth Society

P.S. Ready to make the leap? Don’t let fear paralyze you or let others get ahead of you during this time of opportunity. Just like a carpenter wouldn’t build a house without their hammer and nails, you shouldn’t buy a business without the toolkit Carl has put together.

Find out how to get yours – and start your business-buying journey today.