I was on Brian Rose’s London Real show a few weeks ago. And he asked me arguably the most important question in dealmaking…

What does a perfect deal look like?

Believe it or not, the answer I gave Brian then hasn’t changed AT ALL… even though the coronavirus has since turned our world upside down.

It’s a three-part answer, and I’ll walk you through each part.

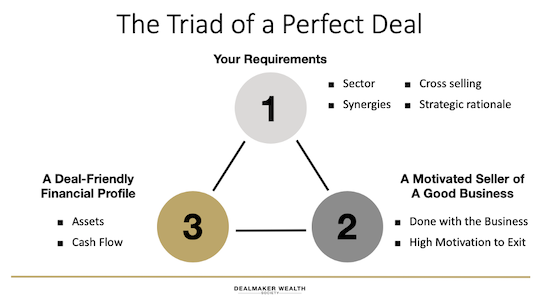

To start, I’m going to share a tool with you. I call it my “Perfect Deal Triad.” Each pillar will help you narrow your deal specification so you can identify the opportunities that are perfect for YOU.

Here it is…

PILLAR ONE – YOUR REQUIREMENTS

This pillar will be different depending on who you are.

A person who is buying a business for the first time won’t have the same requirements as an existing business owner who wants to grow exponentially through acquisition.

If you’re a first-time business buyer, your requirements will be linked to who you are – your passion, skills and experience. You want to buy a business and benefit MASSIVELY from business ownership.

Benefits like cash flow… wealth creation… freedom… work-life balance… pride… fulfillment… legacy…

You may have other reasons as well.

Your choice of business (especially for your first deal) will be determined by a few things…

First, sector. What industry sectors or niches do you know and understand? Where have you worked in the past? What types of businesses are you most familiar with?

It’s important you stay within your lane because it’s so much EASIER to build relationships with sellers and intermediaries (accountants, lawyers, financiers, wealth managers, etc.) if you can have meaningful conversations.

Equally important – you also need a sector you are passionate about. This will help keep you motivated and engaged throughout the deal process and beyond.

And if you are passionate about a certain sector but you don’t have the necessary chops, go partner with someone who does and buy the business together.

Another major consideration – especially for first-time business buyers – is deciding whether you want to be an owner-investor… or an owner-manager.

The former works ON the business. Handles strategy. Oversees growth.

The latter works IN the business. Doing the daily tactical management. Keeping the train on the tracks.

I don’t work in ANY of my businesses. I’m a pure owner-investor.

But there is no right or wrong answer. It’s totally fine if you want to roll up your sleeves and operate the business you buy.

If you do, though, the business needs to be located close to where you live or where you want to live. Makes sense, right?

Conversely, if you own a business already, you are looking for a business that will help you massively scale.

If you have a business with $1 million in revenue today, it may take you years to double it.

But if you buy another $1 million business and COMBINE it with your existing business – finding cross-selling opportunities and financial synergies to optimize operations – you can scale MUCH faster.

Looking at strategic rationale, you may want to buy a competitor and increase your market share. Think one transport business buying another transport business.

Or you may want to vertically integrate in your niche by buying a supplier, customer or partner. Think an engineering business buying a component supplier.

Or perhaps you want to enter a complementary market. Think a software business acquiring an IT services business – same customers, different products and services.

Answering all of the above is what will give you your deal specification. In other words, what does your dream business look like?

PILLAR TWO – THE SELLER

Once you know the type of business you want to buy and why, next you need to find the right seller.

The right seller will be a highly motivated (even distressed) seller of a GOOD business – profitable, positive reputation, solid team, quality products and services, loyal customers.

You don’t want a BAD business – no profit, declining revenues, weak balance sheet, bad reputation. These are turnaround deals and require a very specific expertise (and a good deal of work).

But you DO want a distressed or highly motivated seller.

Sellers who value legacy and safeguarding of employees MORE than money.

You want a seller who wants to retire because they are frustrated, out of ideas, burned out, bored, sick or even dying (or needs to take care of someone who is).

You also want someone who doesn’t have an heir to take over the business (or one who wants to).

Once you find that perfect seller and identify WHY they want to sell, you can start building rapport… and position yourself as the safe, trusted pair of hands to carry on their business.

Then it’s time to consider the final pillar in the perfect deal triad…

PILLAR THREE – THE FINANCIAL PROFILE

The more motivated the seller is, the less the deal will rely on the numbers.

If you find a REALLY distressed seller, they may agree to GIVE you the business. Or let you pay for it 100% seller-financed – effectively, you would split future profits with the seller – which is why it’s key to look for businesses with good assets and/or positive cash flow.

I predict we’re going to see a LOT more motivated sellers on the other side of this coronavirus situation.

So while it is important to understand what to look for in a business’s financials, the numbers will matter far less if you have a highly distressed seller looking for an exit.

And like I said, even though the marketplace is changing, these three pillars still stand.

The PERFECT deal is one that…

And I don’t see that changing anytime soon.

I’ll be back soon with another dealmaking confession….

Until then, bye for now,

Carl Allen

Editor and co-founder, Dealmaker Wealth Society

P.S. The second lesson in my Dealmaker 10-Day Business Buying Launch training covers Dream Deal Specification (DDS) in greater depth. It includes a DDS worksheet to help you home in on your perfect deal. This 10-day course is designed so you can learn how to source, fully fund, and acquire a small business in 10 days or less. Get started here.