Last week was a bit sad…

Someone I admired very much passed away at 84 years of age.

John Francis Welch Jr.

Jack Welch – as we all knew and admired him

Jack was one of the most successful CEOs in corporate America. During his tenure as chairman and CEO of General Electric (GE), he increased the market value of GE from $14 billion to $410 billion.

That’s a $396 billion increase in shareholder value – not bad!

Although I worked on deals with GE early in my career as an investment banker, I never met the great man…

… Until Jack guest lectured during my MBA program at the University of Chicago.

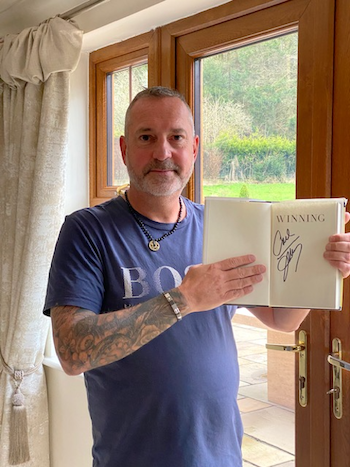

He was launching his new book at the time – Winning – and he graciously signed a copy for me.

I will never forget the firmness of his handshake. It was almost bone-crushing.

But he gave me a great smile as he did it.

That was Jack. Very firm, but very fair. A tough guy with a big heart.

In his first book, Jack: Straight From the Gut, Jack shares some of the tools and management styles he used to lead a global team of people at GE and build an amazing culture founded on hard work and success-based rewards.

Jack had this brilliant saying, “Sometimes you have to hug people and sometimes you have to kick them.”

It’s true – I have used this motivational tactic with all the businesses I’ve acquired in the past 12 years.

Sometimes you need an arm around the shoulder and reassuring words…

Sometimes you need a big kick in the butt to keep you moving forward, keep improving.

Another tool of Jack’s I have used successfully is his 20/70/10 method for ranking employees and financially rewarding them based on the result.

One of the largest personal deals I closed in 2011 was an $18 million business that manufactured corporate uniforms. I acquired this company with a business partner from a $9 billion corporation that didn’t want to own it anymore.

It was a sleepy – although very profitable – business. But we needed to shake up the employee base and inject some energy and leadership. Corporate had let them fester.

I thought of Jack.

And implemented his 20/70/10 tool immediately.

Basically, you take all of your employees (we had over 100 at the time) and segment them into THREE buckets.

The top 20% are the A players. The superstars. These are the people who move the needle in your business – for your revenue, cash flow, valuation and, ultimately, your personal net worth.

The folks who drive your wealth creation deserve to be massively rewarded. You disproportionately pay these people way more than the rest. We did that with shares and big bonuses. Some of my employees used to earn more from the business than I did.

That happens inside of Agora, the large company that acquired my Ninja Acquisitions training business last year. Inside Agora, the highest-paid employee is not the CEO – it’s a copywriter who creates the high-converting copy that brings in sales revenue.

Makes perfect sense, right? Reward the folks who massively move the needle.

The middle 70% are your workhorses. These are the people all businesses need. They are dependable, solid, trustworthy and happy. They may not be A players, but they are vital. These people earn market-rate salaries.

The bottom 10%… you cut them. Every year.

It sounds harsh, but you’re actually doing them a favor. They are not right for your business if they can’t add value. And they will be happier, more successful and way more fulfilled elsewhere. Cut them, take care of them in the right way and help them move on.

We used the 20/70/10 evaluation method in my corporate uniforms business and it worked like a charm.

What else did I learn from Jack?

That guy was a dealmaker.

Several major deals GE closed during his tenure really moved the needle. They helped diversify the business into new, emerging markets. And gave it the opportunity to double down in its key profitable divisions, including aerospace, financial services and high-end manufacturing.

And Jack was very magnanimous in his dealmaking. He always wanted the other party to feel they had got the better end of the deal. Leave a little money on the table for them.

He did occasionally make mistakes. In fact, he once blew the roof off a factory!

But it’s all right to make mistakes as a dealmaker. You’re still human. What’s important is you LEARN from your mistakes, GET UP off the mat and KEEP pushing forward.

Jack Welch proved you can be a tough dealmaker and negotiator as well as a really nice person. Sometimes negotiations get tricky, but the key is to ALWAYS maintain the relationship.

And be nice to people. If you treat people with respect and kindness, it will take you a very long way.

On a personal note…

Jack was married three times. He travelled the world overseeing his expanding GE empire and it definitely took its toll on his personal relationships.

That happened to me. My thirst for dealmaking and travel ended my first marriage to the mother of my eldest son, Ryan.

But I won’t make the same mistake again.

I no longer work IN any of my businesses. And although I do travel (a lot), much of it is with my amazing family in tow – they love to tag along.

The point of this tribute is that success leaves clues. Look to people like Jack Welch (and yours truly) to learn from their accomplishments.

See what traits and strategies you can model and implement in your life… your deals… and your businesses.

Be a good person. Treat people well and focus heavily on your relationships – in both your personal and professional networks.

RIP Jack. It was a pleasure to have met you.

Until next time, bye for now.

Carl Allen

Editor and co-founder, Dealmaker Wealth Society

P.S. Jack Welch was always on the lookout for deals that would move the needle. That’s one reason it’s so important to build a healthy deal origination pipeline… so you have a constant stream of high-quality deals that are ready for you to act on when the time is right.

For my money – the time is right, right now.