I once made $9,687 per hour for basically being a really nice guy.

How?

Keep reading, it’ll blow your mind.

But first, let me relate this story to an important question I’m often asked about closing deals…

“At what point do I tell the seller this deal is going to be a leveraged buyout (LBO)?”

The truth is – I NEVER use the term “LBO” when it comes to buying a business.

LBO is a Wall Street term that describes the process for acquiring a business primarily using other people’s money (OPM).

But at some point during your discussions, the seller or the broker (if it’s a broker deal) will ask you…

“How do you plan to finance the purchase of the business?”

Here’s what I would tell them:

“I plan to finance this purchase using a mix of equity, debt and seller financing.”

Equity is cash injected into the business that isn’t loaned. It could be the surplus cash in the business, a private investor (an angel, even a venture capitalist or micro private equity firm) or, worst-case scenario, some of your own money.

Debt is financing secured against the business’s balance sheet assets or cash flows. Think receivables financing… a loan on plant, equipment or real estate… or an SBA 7(a) loan.

Seller financing is regular future payments you make to the seller using some of the business’s cash flows.

If you get this question early in the process, you do not need to define the percentages of each.

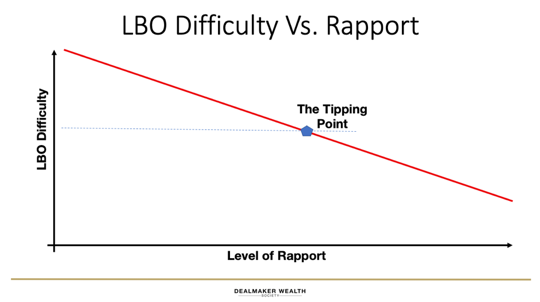

The key to skewing this mix in your favor – so that it’s ideally all debt and seller financing, with little to no equity – is shown in the chart below…

It’s all about the level of rapport and the relationship you build.

If you spend 10 minutes with a seller and launch into an LBO-style offer, it’s very rarely going to work.

There are two factors that determine the ease of structuring an LBO deal on any small business.

One is the seller’s motivation or level of distress. If you have a happy young seller, it’s difficult to pull this off.

Alternatively, if you have a seller that is highly motivated to sell due to sickness, boredom, frustration, burnout, retirement, etc. – then it becomes much easier to pitch them.

Combine this with the second factor… the strength of your relationship.

Even when you find a distressed, highly motivated seller, they are looking for FOUR things:

Trust… credibility… rapport… and a safe pair of hands.

Demonstrate all four and you will be well on your way to closing the deal.

How?

Trust – Go to meetings incognito. Agree to initially meet off-site. Tell the seller you like their business and want to potentially buy it.

Acknowledge the employees and customers will probably not know it’s for sale and that you respect the sensitivity of the conversations. Agree to sign a nondisclosure agreement (NDA) so you can receive any confidential business information in order to make an offer.

Credibility – Stay in your lane. Buy a business that resonates with your sector knowledge, skills and experiences… It should be a business you are passionate about.

Passion and experience are a POWERFUL combination for having meaningful conversations with sellers and the financiers and intermediaries (CPAs, lawyers, etc.) you will eventually need to close the deal.

Rapport – Remember, this is a RELATIONSHIP business. It’s critical to invest time building a relationship with the seller so you can reach the tipping point where the seller KNOWS you… LIKES you… TRUSTS you… and WANTS you to own their business.

Find out all you can about the seller, including their family, hobbies and interests. When you meet them, use the information you’ve gathered to drive deep, meaningful conversations on topics that highly resonate with you too.

And don’t forget to position yourself as the safe pair of hands – Most small-business owners will not sell to a competitor who will likely destroy the business by firing the employees and ignoring its brand, legacy and culture.

This is the hand of cards you MUST play to reach the tipping point.

Because once you’re there…

It will matter far less how you structure the deal.

The valuation of the business and structure of the deal will be mutually agreed upon through negotiation.

The seller will be much more likely to assist you on the financing by allowing a percentage of the deal to be seller financed.

And they’ll allow you to pledge the assets of the business to secure external financing for a closing payment.

Which brings me back to my mind-blowing story…

I acquired an agency business back in 2018.

The asking price was $300,000 with a $250,000 closing payment.

That’s before I spent any time with the seller.

Then I spent a bunch of time with her. Almost 24 hours, including travel to and from the business, meetings and follow-up conversations.

And I did a lot of things.

I flew out to where she lived. Rented a sports car, paid her a ton of compliments, invested time learning about her family (including her late husband). I even accepted an invitation to visit her home, where she cooked me breakfast.

A full 24 hours of relationship building.

The outcome?

I acquired the business for $117,500 – a $17,500 closing payment and a negotiated seller financing payment of $100,000 to be made annually for two years.

The time I invested in the relationship SAVED me $232,500 (the $250,000 closing payment she was originally hoping for, less the $17,500 I actually paid.)

That’s $9,687 per hour ($232,500 divided by 24 hours)… just for being a nice guy.

Could you be nice to people for almost $10,000 per hour?

If so, then you can do deals. I’m not joking.

We are in a relationship business.

Go build world-class seller relationships and buy businesses.

Speak soon.

Until then, bye for now.

Carl Allen

Editor and co-founder, Dealmaker Wealth Society