Here’s a question I’m asked ALL the time…

“Carl – how do you make money doing a leveraged buyout (LBO)?”

First, remember that LBO is a Wall Street term (where I used to work).

For nearly two decades, I learned the ins and outs of LBOs doing deals for mega-corporations like Microsoft, Hewlett-Packard and Bank of America…

Essentially, an LBO is a way to buy a business using other people’s money – OPM for short.

And there’s not one but THREE ways you can make money from this type of deal:

Today, I’ll go over each of these ways using an example business.

Say it’s a professional services business – think marketing firm, PR company or advertising agency.

The only assets it has are (a) cash on the balance sheet and (b) receivables (which you can finance to generate a closing payment).

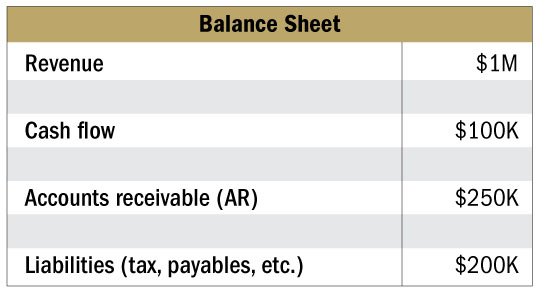

Here is the balance sheet we’ll use for this hypothetical:

Now, let’s go over the three different ways you can make money doing an LBO deal in this scenario.

As you know, we buy businesses at a multiple of cash flow.

For this business, you will probably pay, on average, 2.5X the cash flow. In this case, $250K. Not rocket science.

But – HOLD ON – you may think. The balance sheet is worth $150K… so why would I pay $250K to buy the business?

(Remember, the total assets here are the cash flow plus the accounts receivable (AR), so $350K. Owner’s equity, or the value of the balance sheet, is calculated by subtracting liabilities from the total assets, so $350K — $200K = $150K.)

That difference is called GOODWILL. It’s the business’s ability to continue to generate revenue and cash flow from its operations.

Now let’s look at the cash – $100K. Enough to safely operate the business, but not much to use for a closing payment. You could squeeze $25K out of it… but I say leave it for now.

With the AR… a $250K balance will likely net you around $200K, or 80%, in financing.

I would use $150K of that for a closing payment and keep $50K. You might have a total of about $25K in fees and closing costs for your contingent-fee advisers, which leaves $25K surplus.

You can take out that cash if you want. Think of it as a closing payment to yourself.

Me, I don’t do this anymore. I prefer to reinvest that cash back into the business to grow it faster… which drives more cash flow to you if you go with the second or third option below. But the choice is yours.

To recap… The asking price is $250K. We have a closing payment of $150K. That leaves $100K we still need to pay for the business – over time – using seller financing.

I would offer $25K per year over four years = $100K.

There are no adjustments for surplus cash or nonoperating assets like real estate…

And the business’s liabilities are not long-term debt obligations, so we don’t need to lower the valuation.

Instead, the liabilities are accounts payable (AP) and some payroll taxes. Sometimes I negotiate for an exclusion, but I’d inherit these obligations as part of this deal.

Now, look at the annual cash flow… $100K – minus the $25K per year we need to pay the seller. So before we grow the business AT ALL, there’s $75K per year in cash flow that’s YOURS.

Because YOU own the business now.

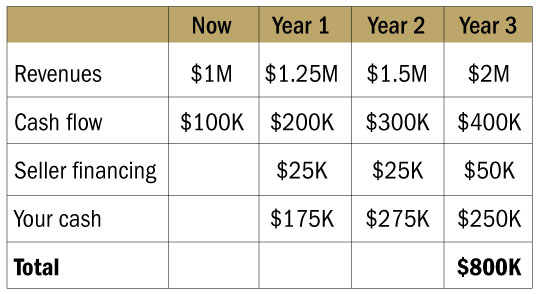

Let’s assume you own this business for three years…

After three years, you’ve grown the business to $2 million with cash flow of $400K.

And now that the business is generating $400K per year, you can sell it for a higher multiple than you acquired it for. Probably 3—4X. Let’s take 3.5X as an average.

If the business is worth 3.5 x $400K, that equals $1.4 million.

Assume these were the growth numbers:

You’ll notice in the chart above we pay the seller financing for the last two years all in year three just to clear it down.

By doing so, you can MAKE $800K in just three years by pocketing all the surplus cash flow that’s YOURS as the new owner of the business.

So, to summarize….

The cash you can take out at closing = $25K

The cash flow over three years as the owner = $800K

The cash when you SELL the business at a 3.5X multiple = $1.4 million…

Your total profit = $2.23 million.

Your investment = $0 (provided you closed the deal using my Dealmaker CEO system).

Your return on investment (ROI) = INFINITY – think legacy, pride and purpose… not just pure wealth creation.

Even if you used $25K of your own cash to close this deal – but why would you do that? – your ROI would still be 8,900% ($2.23 million/$25K).

Not bad for just one deal.

There are endless combinations of these methods…

The bottom line is you CAN buy a business without using ANY of your own money and absolutely CHANGE your life in just a few short years.

I’m not joking.

That’s why I want to invite you to the Stay-at-Home Millionaire Summit on Tuesday, April 28, at 1:00 p.m. ET (6:00 p.m. BST). It’s a once-in-a-lifetime training event we’re putting together to make sure you’ll never have to worry about being fired, furloughed or flat-out frustrated ever again.

Click here for your invitation to join us next Tuesday.

I hope to see you there.

Until then, bye for now.

Carl Allen

Editor and co-founder, Dealmaker Wealth Society

P.S. I’m doing next Tuesday’s event for FREE because I firmly believe there’s no time like RIGHT NOW to take a hard look at your life and figure out if you’re doing the things that make you feel truly fulfilled.

I’m not exaggerating when I say my course has MASSIVELY changed the lives of thousands of my students for the better. And now I want it to change yours too!

Click here now to register for the FREE Stay-at-Home Millionaire Summit.