There’s a very important distinction I want to clarify today…

In dealmaking, we use the word DISTRESSED a lot.

Sometimes you will hear the phrase DISTRESSED BUSINESS, and other times you will hear us say DISTRESSED SELLER.

But there is a MASSIVE difference between the two. Let me explain…

A distressed business is a business in trouble.

It’s likely running dangerously short on cash… Key employees are leaving… Customers are going elsewhere… Maybe it’s subject to some serious litigation… Perhaps the product has problems… Or it could simply have a fundamentally flawed business model.

Think of a distressed business like a run-down house. Not fit to live in – but with some time and effort, you could flip it (turn it around) and make a profit (sell it).

You can acquire a distressed business for just $1. But that raises a lot of questions…

Can the business be saved, or has too much damage been done?

Do you have the chops to save the business?

Does the business need capital to turn it around? If so, do you have enough?

It’s unlikely you’ll be able to raise financing against a distressed business, so you’ll have to generate any investment cash from internal operations – selling obsolete assets, making massive cost savings, etc.

Then once you finally turn it around, will someone buy it and pay enough to give you a return on the time and money you invested to keep the lights on?

Nope – I’m not a distressed-deals kind of guy.

I would rather buy a GOOD business from a distressed SELLER.

A business that’s profitable…

Has good employees, loyal customers, a coveted brand, solid operations and a bright future…

It’s the seller who’s distressed – NOT the business.

The seller may be distressed for many reasons…

They may want to retire. Forbes tells us 10,000 baby boomers are retiring in the U.S. every day… and 18.3% of them own small businesses.

That’s 1,830 businesses hitting the market PER DAY. And only one in 11 – even as few as one in 14 – will sell within the first 12 months.

The seller could also be burned out. Frustrated. Sick. Even dying in some cases. And not just the seller. Family members as well.

Or the seller may have just run out of ideas and feel they have taken the business as far as possible. They just don’t have the mindset to keep pushing it to higher levels.

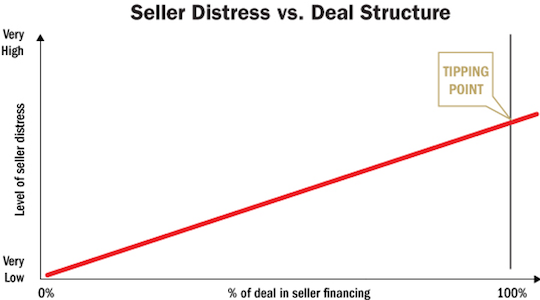

The key point here is the degree of seller distress is directly proportional to the amount of the deal you can park into seller financing.

For a moderately distressed seller, you will most likely have to use a closing payment in your deal structure. But don’t worry – you can use other people’s money (OPM) for that.

You can finance the assets on the balance sheet… leverage the cash flows in the business… even partner with an equity investor.

Find a severely distressed seller and you can buy 100% of the business without using ANY external financing.

You can use the surplus cash in the business – cash on the balance sheet over and above what the business needs to comfortably operate – to cover a small closing payment and the seller’s closing costs. The rest of the deal can be paid over a period using seller financing and potential earn-outs.

So which should you target – distressed businesses or distressed sellers?

Well, that depends.

If you have never acquired a business before and don’t currently own a business, my advice is to focus ENTIRELY on distressed sellers. It will save you the heartache of having to dive into a distressed business and turn it around.

However – if you have serious turnaround chops, a ton of time on your hands and nerves of steel, a distressed business could be a good opportunity for you.

Or if you own a business already, bolting on a similar distressed business is much easier.

Why?

Because you already have what you need to fix it – an experienced team, processes in place, loyal customers and products you can cross-sell.

With a bolt-on, you are essentially acquiring products, services, customers and potentially a few additional employees. You can leave everything else behind.

It’s like √† la carte dining – just acquire the assets you want…

Add to gross margin to your business.

If you don’t own a business already, you can’t combine businesses and have that instant cash impact. That’s why, especially for your first deal, I recommend focusing on highly distressed SELLERS.

Of course, as an existing business owner you can also buy a good business from a distressed seller. Through cross-selling and cost savings, your combined revenue and gross margin will be much higher.

I will see you soon for more Confessions…

Until then, bye for now.

Carl Allen

Editor and co-founder, Dealmaker Wealth Society

P.S. Once you’ve identified a few distressed sellers, what’s the best way to approach them? Directly, of course! In the Dealmaker Launchpad training course, you get my direct-approach letter template that you can download, fill in and send off. Piece of cake.

Plus, you can get through the entire Dealmaker Launchpad course in just seven days! Which means you could be contacting potential sellers as soon as one week from now. What are you waiting for? Join Dealmaker Launchpad today.