Here’s a question I have seen pop up frequently in the past few weeks – both in response to Confessions of a Dealmaker and in the private Facebook groups of our various training programs…

“I have almost raised all the funding to close my deal, but I’m 5—15% short. What do I do?”

Great question!

There are multiple answers – which I’ll cover today.

First, let’s run a quick example…

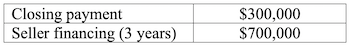

Assume you’re buying a business for $1 million and you’ve structured the deal as follows:

You don’t require any additional working capital. However, you do need $50,000 for contingent closing fees and some cash off the table for yourself.

Which brings you up to $350,000 to close.

Now let’s say you are $100,000 short (10% of the total).

You have provided asset information to financiers and you have $250,000 in the bag, but you still need that last sliver of funding.

Here are FOUR ways you can close the deal:

If you have built MASSIVE rapport and the seller knows you, likes you and trusts you, the solution may be as simple as adding the $100,000 shortfall into the existing $700,000 seller financing for a total of $800,000.

You could either add an extra year to the payment schedule – over four years instead of three – or, if cash flows allow, keep it to three years with higher payments.

If necessary, you could sweeten the deal by paying $1.1 million with a $200,000 closing payment (your $250,000 finance raise minus the $50,000 for fees and personal drawdown). Then you would definitely want to pay the seller financing over the full four years.

The seller may be open to retaining a small percentage of the business – in this case 10% since you are 10% of the total deal short. Or you could offer to only buy 80% and leave the seller with the remaining 20%.

It’s much better to own and control 80% of a business versus 100% of nothing.

You could also include an option to buy the remaining 20% later. The seller might LOVE this idea, because it keeps them invested in the future success. The seller may even want to work part time post-closing to assist you in growing the business.

If you haven’t purchased the additional 20% from the seller by the time you grow the business and sell it, they will receive another payday. This can also be very attractive.

If the seller doesn’t want to retain any equity, go sell that equity piece to an investor. This could be an angel investor who also has industry experience and a solid network you can leverage for business development.

That’s a massive value-add to both the business and the deal – you get the additional financing you need and a partner to help you grow.

Now, if you are just 10% of the deal short, the investor may want 20% of the equity or more. But again – it’s better to own SOME percentage of the business than 100% of nothing.

If the seller agrees, there are multiple ways to raise another closing payment within 90 days…

As the owner of the business, you can crowdfund by selling a piece of equity.

Crowdfunding doesn’t come with the massive value-add you see typically with an angel investor. However, the valuation can be at a premium so the funds you raise will dilute you much less versus an angel investor.

You can also financially engineer the balance sheet. For example, if receivables are high and payables are low, you can collect cash from customers faster and pay suppliers later so you generate cash flow much faster.

You can sell off surplus fixed assets and inventory (provided these items aren’t secured by the $250,000 financing you raised to close the deal).

You can build cash by preselling your customers at a discount, or, worst case, by borrowing from your retirement savings.

In summary, there are many ways you can close the gap to cover that last sliver of funding.

You can even combine some or all of these solutions to get the deal across the line. The key is be creative with your deal structure.

And when you have a solid foundation of trust, credibility and rapport – and the seller knows, likes and trusts you – you can leverage that relationship to find out what the seller really wants.

That’s all for today. Keep your dealmaking questions coming in…

Until next time, bye for now.

Carl Allen

Editor and co-founder, Dealmaker Wealth Society

P.S. Adam and I absolutely LOVE answering your questions! Whether it’s an open Q&A on YouTube… a Facebook Live event… or right here in Confessions… we want to make sure you understand the nuts and bolts of buying a business.

If you have a question about ANY aspect of the dealmaking process, email it to [email protected]. As Adam always says, you’re only one deal away…