I talk about this all the time – but it bears repeating.

There is a MASSIVE difference between being an owner-manager and an owner-investor of a small business.

As an owner-manager, you are essentially the general manger (GM) of the business. You run the business day to day.

For some dealmakers, that’s exactly what they want to do. And there’s nothing wrong with that.

Owner-investors, on the other hand, don’t work IN the business. Instead, they hire or partner with a GM to handle the daily operations.

Owner-investors focus on FIVE things:

These are the BIG things that moves the needle. This is what I do.

And as an owner-investor, you can own multiple businesses, located anywhere in the world!

If being an owner-investor is the path you’d choose, here is how to manage those businesses virtually in FIVE simple steps…

This is really important because if the business cannot operate without you (the owner) in it every day, then it’s going to be difficult for you to sell the business later.

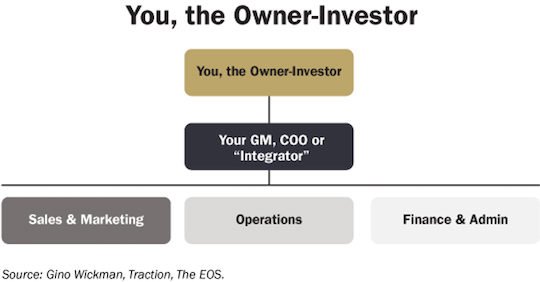

I have used many frameworks over the years – the EMyth system… Action Coach… Strategic Coach… But my favorite is the entrepreneurial operating system (EOS) designed by Gino Wickman in his amazing book Traction.

This framework helps you structure the business in a really simple way.

You, the owner-investor, are the visionary. You are only responsible for focusing on the FIVE tasks listed above.

Your GM is known as your “integrator.” They are responsible for the day-to-day operations, all the technical and tactical work. They are also tasked with implementing your strategic plan (and incentivized accordingly).

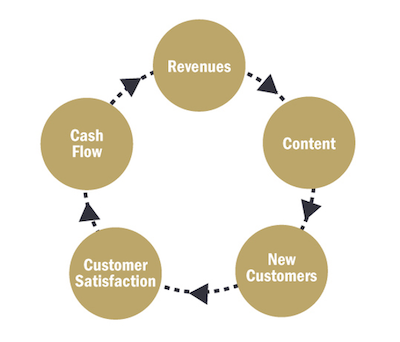

When I rapidly scaled Ninja Acquisitions prior to selling to Agora Financial, 80% of my GM’s compensation was tied to this framework and hitting the strategic goals that would move the five levers inside the business – revenues, new programs, cash flow, net new customers and customer satisfaction ratings (illustrated in the flywheel below).

All five areas are intertwined and one can positively (or negatively) impact the others. Everyone who works in the business reports to your GM, who reports to you.

Part of your GM’s job is to keep tabs on all departments – sales and marketing, operations, finance and administration – to ensure everyone is pulling the right levers to spur growth.

Your GM can come from multiple places. They may be…

Once you have your GM, you need to make them feel like a partner. Gift them some equity or just create a profit share.

I have done both.

In Radio Express, I gave my GM Paul 40% of the equity. In Ninja, my GM Richard had a profit share interest but no physical equity.

In Walton Swift, Jason and I split the profits 50/50 – but I was the visionary (owner-investor) and he was the integrator (GM).

In Shark Shield, Lyndsay was the visionary, Amanda was the integrator and I just closed the deal. But we were all equal partners in the upside.

From the word GO, you need a strategic plan for the business.

It starts with understanding where the business is now and planning where you want it to be in the future – probably when you decide you will sell. That way you can reverse-engineer your growth strategy from the wealth you want to create.

As part of your commercial due diligence, you will have done a GSWOT analysis. GSWOT stands for: growth strategy, strengths, weaknesses, opportunities and threats.

This will help you define a set of objectives, work processes and financial targets along the way. These you can review as part of Step 5.

Each business – and the working relationships within – is different. But here is my starting point…

And in larger deals, I implement formal monthly board meetings.

You need to strike a balance. Let your GM run the business, but with a level of oversight that makes you feel comfortable so you know if the business is on track and hitting its targets.

This step is all about knowing your numbers and key performance indicators (KPIs). If business is a game, this is the score. And a game is no fun if you don’t know the score.

I have a simple set of KPIs I track across all my businesses – plus some have unique ones depending on the industry or particular business. These track closely to the flywheel I illustrated above.

I’m always tracking weekly revenues and cash flow… customer acquisition… marketing ROI (what the business spends to acquire customers)… customer satisfactions metrics…

And so on.

Whether you’re the owner-investor or GM yourself, it’s important to know if you’re winning the game you are playing.

And if you are happy being a GM, go find a visionary to support you and add some strategic bandwidth into your business.

Perhaps an angel investor who also wants to partner with you in the deal – so you get the cash AND the brainpower.

It’s all up to you.

Until next time, bye for now.

Carl Allen

Editor and co-founder, Dealmaker Wealth Society

P.S. After you decide if you want to be an owner-manager or owner-investor, you’ve got to buy a business!

Step 1 is identifying opportunities.

My seven-day Dealmaker Launchpad course will show you how to set up a killer deal origination funnel – for a constant stream of high-quality deals that fit your deal specification.

Think about it – ONE WEEK from now you could be swimming in deals! The hard part will be choosing which ones to pursue…