If you own a business right now – whether it’s one you started or one you acquired –chances are you are working IN the business instead of working ON the business.

Working IN the business means the business is heavily reliant on you.

All the systems and processes are in your head… All the major customer relationships are yours… You make all the key decisions…

And you’re struggling to grow as you hustle every day to add new customers into your business one by one.

You are probably working crazy long hours – there’s not a lot of delegation happening.

Cash flow may be a problem…

It’s hard to motivate and lead your employees. As a result, it’s a constant battle to retain good people inside of your business – finding new talent is even harder.

With the businesses I own, I don’t have any of those issues.

Because I only work ON my businesses, not IN them.

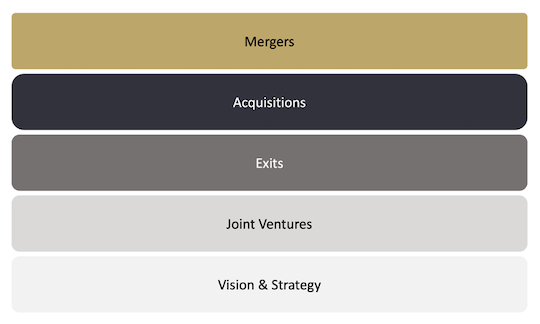

As an owner-investor – versus an owner-operator or owner-manager – there are only FIVE things you need to do to scale your business.

First hire a general manager (GM) to handle the business’s day-to-day operations. Then as the CEO focus on ONLY these five things…

Notice you don’t see sales, marketing, finance, operations, admin OR customer service on this list. Instead, these are things that will move the needle in your business empire.

Now let’s run through them…

A merger is when you and a target business come together and share in the ownership of the combined entity.

For example, you may own a landscaping business and someone you know owns a hardscaping business. Similar customers, but different offerings. So why not combine?

The good thing about a merger is that no cash changes hands – you just combine all your operations.

And when you combine the two businesses together there are a lot of cost savings to be had: rent, property taxes, utilities, maintenance, insurance, other overheads, admin costs, professional services, etc. The list goes on.

The tradeoff is you must share in the ownership with the other business owner.

An acquisition is almost identical to a merger. The rationale is exactly the same, but you own the entire combined operation – unless you sell equity to an investor to help finance the closing payment on the deal.

You still get to cross-sell products and services between the two sets of customers and enjoy the massive financial benefits from combining two complementary businesses together.

Acquisitions come in THREE forms:

1. Buy a competitor. For example, a plumbing business buys another plumbing business down the street

2. Buy a business within your supply chain and vertically integrate inside of your industry. One of my students acquired a bunch of optometry businesses (competitors) and then acquired a lens manufacturer to eliminate all the of money he was spending on the lenses.

3. Buy a complementary business to enter a new market. If you own a web design agency, you may acquire a Facebook ads agency. You can sell web design to the ad agency customers and vice versa. Customers would typically need both sets of services and would rather purchase all from one business.

An exit is when you eventually sell the business.

One of the major drivers of exit value is the profit you generate. The higher the profit, the higher the multiple. A business generating $250,000 per year in profit may sell for a 2X multiple, or $500,000.

If you increase your profit to $1 million per year from bolt-on acquisitions, you can now command a 5X multiple when you sell, which is $5 million.

Your business’s value – and your net worth – increases by acquiring other businesses.

A joint venture (JV) is coming together with a likeminded business. You combine some or all of your operations – drive the synergies just like in a merger or acquisition – and share in the upside. However, you don’t join together and become one legal entity.

A simple example of a JV is an affiliate relationship, which is very common in online businesses.

You have a digital product and a list and another business has a different product and list. You simply cross-promote your product to the other list and vice versa – and split the profits.

Finally, you need to focus on defining your vision and strategy for your business and for your empire you are starting to build.

As the CEO of a budding empire, your job is to focus on moving the needle by working ON the business, not IN the business.

This is the critical thinking you must have to build that empire.

Until next time, bye for now.

Carl Allen

Editor and co-founder, Dealmaker Wealth Society

P.S. Looking to grow your business? Look no further than my FREE Dealmaker Empire guide on how to do it the faster, cheaper way through acquisitions.