I was walking in the woods this morning with my dog Blu.

It was super early and my other dogs were still snoring, so it was just me and Blu.

Early into the walk, Blu spotted a cat who raced up into a tree.

Blu – who’s a Weimaraner, a German hunting dog – sprinted across the field and stood perfectly still, laser-focused on the cat, front paw elevated in perfect hunting stance.

It’s a great thing to see. And it reminds me of one of my golden rules when it comes to dealmaking. A rule even I’m super guilty of breaking occasionally…

Don’t give in to DEAL HEAT.

DEAL HEAT is where you only have ONE deal. You laser in on your target (closing the deal) and nothing will stand in your way.

Like Blu… He had HEAT for the cat. He stood there. Would not move. Would not deviate. Would not focus on ANYTHING except staring down the cat. He was salivating. At that moment, he was thinking of nothing but that cat.

He was essentially paralyzed.

Sometimes even the best dealmakers fall into the same trap.

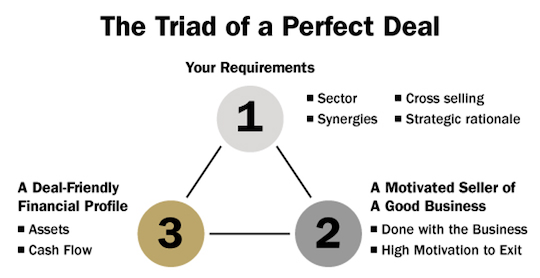

But buying a business is a numbers game… It’s unrealistic to look only at ONE deal and expect it to fit the perfect deal triad.

A quick recap…

Depending on your business experience, skills, dedication and sector knowledge, you may need to have five deals in your pipeline. Maybe 10 or more.

Remember – it’s a numbers game.

When you last purchased a house, did you inspect one and then buy it? Or did you look at five, 10 or 20 before deciding which house was the PERFECT one to buy and live in?

As you know, I moved to a new house just before lockdown. My family and I looked at more than 25 houses before deciding to buy the one we live in now.

We didn’t get HOUSE HEAT – we visited this house FIVE times before we agreed to buy it. And we played the final few off each other until we got the deal we wanted.

You need to approach buying a business the same way. Don’t develop DEAL HEAT.

The seller will constantly ask you to improve and revise your offer… even agree to a host of additional terms…

Because you have no other options, your psychology is different. You feel like can’t walk away from the deal (although you can and you must if the deal moves against you).

Sellers can sense when you have DEAL HEAT and will use it against you.

Despite my 28 years of dealmaking experience, I was personally guilty of this just last December.

Adam and I were closing on a deal within our private equity firm, PROX Capital Group.

It was a truly excellent business – fantastic margins, a world-class team, a CEO-in-waiting from within the business… And this business did virtually NO marketing, so it was ripe to scale.

And we knew we could radically scale the business… bolt on several smaller businesses… and create a massive business we could sell on in the future for a big profit.

This was to be an SBA 7(a) deal. When we looked at the perfect deal triad, it appeared to tick all three boxes…

Pillar 2 was where we got it wrong.

I remember closing vividly. I went to the office of our lawyers in Baltimore and signed what must have been 500 pages of legal and bank documents… all in triplicate.

But then…

The seller pulled out. At the 11th hour.

First, he wanted to delay closing until January. But then he went on vacation for the Christmas holiday and when he returned, he decided it wasn’t the right time to sell.

During the entire deal process, we had bowed to all the seller’s demands. It was a fantastic deal for all. This would have been one of the best businesses I had owned since I started doing my own deals in 2008.

Certainly the deal with the most growth and profit potential.

We had serious DEAL HEAT. But not the seller.

Yes, we had hundreds of other deals in our funnel – but this deal was different. It was the perfect deal from our side. However, the seller… in the end… just didn’t want to sell.

Perhaps we blew him away with our vision for the business and he thought… Hold on, maybe I can do all of that and sell the business for much more in the future.

Who knows?

The moral of this story is – however amazing a deal may be – don’t get DEAL HEAT.

Play each deal against the others and don’t be afraid to walk away if a deal gets too onerous.

Until next time, bye for now.