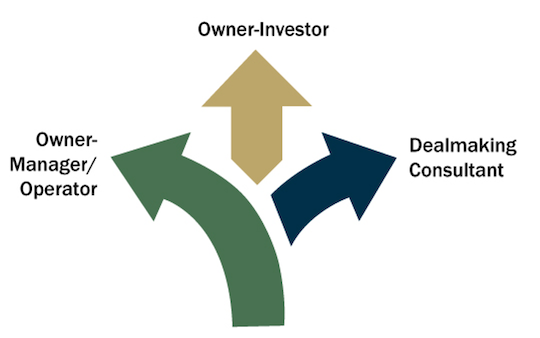

When it comes to dealmaking, there are essentially THREE paths you can take in regard to the types of deals that you are going to do.

The path YOU take is based on who you are and what you want.

If I look across the 5,500 dealmakers inside of all our programs, they basically split into three camps:

Let’s discuss them all…

This path is where you want to buy and then operate the business. You want to go in every day and run it. You are driving the bus.

Clearly, then, your sector of choice is important. You need to buy a business in a sector you know, are passionate about and can add value to (growth, optimization, etc.). And if it’s a sector you know, you probably also have a network you can plug into the business to grow and improve it.

Location is also important. If you are going to be operating the business day to day, then it needs to be close to you or where you want to live.

If you are frustrated in your current employment and want to own your own business, call you own shots and really operate it, this is the way to go.

If you follow the path of an owner-investor, you won’t work IN the business day to day… An owner-investor works ON the business focusing on these five things:

That’s it.

As an owner-investor, the businesses you own can be ANYWHERE. It doesn’t matter. In all cases, you have a general manager (GM) or COO – also fashionably referred to as the “integrator” – handling the day-to-day operations and reporting to you.

You incentivize the GM to grow the business and increase its value. You can compensate the GM via a base salary plus either a PIP (profit interest partnership – effectively a profit share), bonuses based on general performance (revenue growth, profits, major activity accomplished) or GIVING your GM a small piece of equity in the business.

Partnering with a GM can help you close deals in areas where you may not have a ton of experience. The GM will add value to the deal (making it easier for you to build relationships with sellers, brokers, financiers, lawyers, CPAs, etc.) and to the business post-closing.

Pick a GM who has serious chops in the niche where your business plays. They should have proven capability and a track record of doing great things in that sector – and share your passion and excitement for the business you are buying.

This path is you essentially brokering deals – either for high-net-worth investors, entrepreneurs or existing businesses looking to scale via acquisition.

You can consult on the buy side (everyone who is buying) or on the sell side (everyone who is selling). And you can work on multiple deals at once – and work on both sides of different deals (to avoid any conflicts of interest).

Entrepreneurs and small-business owners want to buy businesses, but sometimes they don’t have the bandwidth to run the process. They are too busy growing their businesses organically customer by customer and can’t (or don’t want to) separate themselves from the business to give them the mental space and time to close deals.

That’s where YOU come in. There are some great ways to make money from this path…

You can charge a monthly fee for your services… You can also receive a success fee upon successfully closing deals for your clients… And you may be able to grab some equity in their businesses – especially if you are running the process for someone buying their first business.

Here is a quick example.

You start working with the owner of a $5 million-revenue business who wants to scale by acquisition.

You charge, say, $3K per month for your dealmaking services and you negotiate a $50—100K closing fee that’s paid once a deal is closed.

Alternatively, you may waive that fee and instead receive a small equity percentage in their business, especially if the client wants to continue acquiring businesses.

So those are the THREE paths you can take to become a dealmaker…

Which path suits you best? Discover your deal making adventure when you join our 10 Day Business Buying Launch Program by clicking HERE.

Until next time, bye for now.

Carl Allen

Editor and co-founder, Dealmaker Wealth Society