I was in my marketing mentor Todd Brown’s Top One Mastermind recently and he took us through a very cool strategic flywheel he uses in his business.

Marketing Funnel Automation (MFA) is quickly becoming THE strategic tool many online businesses are using to drive exponential growth.

Naturally, it made me think about our tribe and how you can apply the flywheel concept to buying your very first business.

Before I explain, let me walk you through an example of a flywheel.

One of my favorite businesses is Amazon.. It’s a super-simple yet super-effective business with a market value of $1.6 TRILLION!!

So clearly, Amazon is badass.

I always say success leaves clues. Model what others are doing well and you can crush it in your own endeavors, even if you need to adapt.

That’s what today’s advice is about.

Here’s Amazon’s flywheel …

The concept of a flywheel is that it contains only 5–10 activities that, when executed together, make the figurative wheel spin.

Each activity feeds off the other, and the forward progress compounds until the wheel is spinning so fast it has latent energy and momentum all on its own.

Amazon’s key activities are:

When one of those activities moves, so do the rest.

For example, the more consumer traffic Amazon generates, the more sellers will show up. More sellers generate a wider product assortment. Economies of scale allow Amazon to lower costs and pass those savings on to customers. Cheaper prices mean more traffic… and the flywheel continues to spin.

Very cool. Now let’s look at how we adapt this to buying a business.

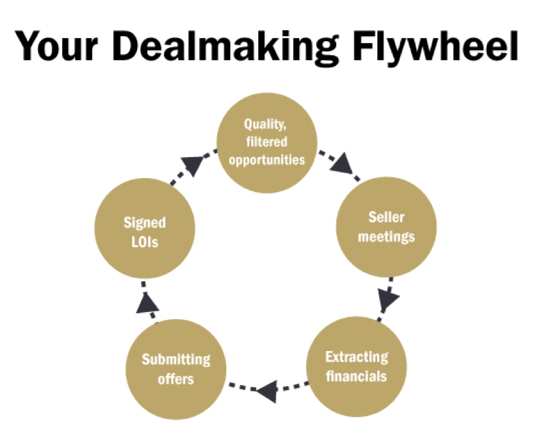

First, let’s list the key activities.

Assuming you have completed your deal specification (i.e., you know what type of business you want to buy and why), the key activities for you will be:

1. Find and filter quality deal opportunities

Here you are identifying suitable opportunities that match your deal specification. You source multiple deals from social media, the direct approach, your network and business brokers (i.e., the big four deal origination strategies.)

The more opportunities you source and qualify, the more seller meetings you’ll end up scheduling.

As a reminder, you should be qualifying deals based on the golden factors of the deal triad: your specifications, a motivated seller and a deal-friendly financial profile.

The goal is to progress only those deals that meet all three factors.

2. Have seller meetings

The more seller meetings you have, the more other opportunities will emerge.

For example, when you first meet a seller it may become clear their business is not actually a good fit for whatever reason. However, if you have a good rapport, the seller may refer you to other businesses looking to sell.

In fact, throughout your deal origination activity you should be building relationships with not only sellers, but brokers, CPAs, lawyers, etc. Once these people get to know, like and trust you, you’ll be amazed how they will start sourcing deals for you.

3. Extract business financials

The more rapport you build with sellers, the more sets of financials you will get access to. The ultimate goal of the first seller meeting is to establish credibility, trust and rapport so the seller gets comfortable enough to share their financial data with you.

And remember why we need this data: so we can complete our initial analysis of the business’s health and — assuming everything checks out — structure a deal and make an offer.

4. Submit offers

The more offers you make, the stronger your chances of success.

Remember, this is a numbers game. You may get lucky and close the very first deal you encounter, but that is rare.

For a deal to meet the golden factors of the deal triad, you may need to look at 20 or so deals depending how refined your specification is as well as the size and scope of your target market.

5. Sign LOIs

Once you make an offer, you will have to negotiate to create a deal structure that’s a win for you and a win for the seller.

After you have agreed to the principal terms, it’s time to put these into a letter of intent (LOI). This two-page executive summary of the deal details all the major deal points, the timetable to closing and any anticipated involvement from the seller post-sale.

A signed LOI indicates both sides are ready to move forward with the final stages of the dealmaking process — conducting due diligence, securing financing and closing the deal.

So that’s your dealmaking flywheel. Make big moves in all five areas and your dealmaking activity will compound and accelerate.

Until next time, bye for now.

Carl Allen

Editor and co-founder, Dealmaker Wealth Society