All businesses need working capital to operate successfully.

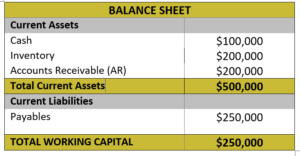

Working capital is calculated by taking the business’s current assets and subtracting its current liabilities.

Cash is the most critical component of working capital, which is why SURPLUS cash comes up as a topic in virtually ALL deals.

So what is surplus cash and why is it important? Let’s take a look…

Assume this is the balance sheet in your deal:

We need to track working capital in deals because it’s the fuel for driving the business. And cash is the spark plug that fires the engine. Without cash, a business can’t trade.

Your inventory and AR can be really high. Your payables can be zero. But cash is required for short term expenses like payroll, rent, utility costs, etc.

Without it, you’re doomed.

Understanding the true cash requirements of a business is a two-stage process…

Stage One

For quickly evaluating deals and making offers, use one month of sales revenue as the minimum cash you will require.

So a business generating $1.2 million annually will require $100K of cash. That’s sufficient to value the business, structure the deal and make an offer.

Stage Two

During the financial due diligence phase of the acquisition process you need to do more in-depth cash flow forecasting, ideally month by month.

Why?

All businesses are seasonal, both in terms of revenue IN to the business and payments OUT (taxes, in particular).

Understanding the lowest cash-generating month is important in the final stage of the deal so you can ensure the business is properly capitalized immediately after closing. (I will cover this in a future post.)

If you are a member of the Dealmaker CEO program, you already know how to do this. There is a video training and model you can use as a guide.

In stage one, understanding the current cash position is critical for a deal.

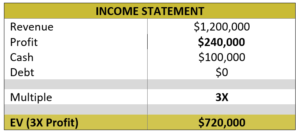

Imagine you are making an offer on a business with the following financials:

This is a simple calculation. Assuming you are buying at a 3X multiple, the enterprise value (EV) would be $720K. There is no debt to inherit and therefore nothing to subtract from the deal.

The cash is $100K, which is the ideal amount. So no SURPLUS cash, but no cash DEFICIT either.

If we had a cash DEFICIT, there’d be less cash than you need. So if there was only $50K in cash, you would REDUCE the purchase price by $50K.

But if the cash was $200K, you would have a $100K SURPLUS. This is the cash owned by the business (and therefore the owner) over and above the minimum amount needed to trade.

With surplus cash, although you’d ADD it to the purchase price, you can use it for financing the closing payment.

In other words, with $200K in cash the deal would now be valued at $820K ($720K + $100K surplus). You are essentially buying the cash from the owner at the time of closing and then using it to close the deal.

Why do businesses build up surplus cash? There could be several reasons.

Some business owners also like to be conservative and keep a healthy cash balance in the business as a safety net. Others want a war chest so they can seize on sudden opportunities that may require additional working capital.

Some owners may build up surplus cash for tax reasons. In the U.K. for example, the tax rate on selling a business (including the cash inside of it) is LESS than it would be for drawing that cash as a salary, bonus or dividend.

In summary, you should target one-twelfth of annual revenue as the minimum cash needed in the business at the time of closing.

Cash ABOVE that is considered surplus and needs to be added to the valuation, although you can use it to finance the closing payment.

Cash BELOW that is deficit cash and needs to be subtracted from the valuation. In this case, you may need to allocate some of your acquisition financing to top off the cash balance in the business.

Most financiers (including the SBA) will provide acquisition financing plus separate working capital financing to trade (and grow) the business.

So that’s the concept of surplus cash. How to calculate it, adjust for it and even use it to finance a deal. Remember…

Revenue is vanity. Profit is sanity. But CASH is REALITY.

Until next time, bye for now.

P.S. I’m always looking for tips on what topics related to the business buying process you’d like to know more about? Click here to let me know and I’ll address them in upcoming posts!