I saw a great question in the mailbag recently that warrants a deeper explanation.

The question was: Which is more important — profit or cash flow?

It reminded me of an old saying I like to reference from time to time…

Revenue is vanity. Profit is sanity. But cash flow is REALITY.

Let me explain.

Without revenue, you don’t have a business because no one is buying your products or services.

But it’s not the key metric.

Obviously, if it costs you more to produce a product or service than what you can get for it, you’ll lose money.

Therefore, profit is more important than revenue.

But “profit” is an accounting term. There are non-cash items that can influence a business’s profit line, like depreciation of fixed assets, amortization of goodwill, R&D expenses, and other intangible assets.

Let’s run through an example…

Super Inc. has the following income statement:

Revenue $1,000,000

Cost of Sales ($500,000)

Gross Profit $500,000

Overhead ($400,000)

Net Profit $100,000

Taxes ($20,000)

Retained Earnings $80,000

But profit (or retained earnings) isn’t cash. To understand cash flow (CF), we need to break it into three components:

The free cash flow (FCF) of the business equals the sum of all three.

Operating cash flow is generated by the operations of the business. That includes profits, adjustments for non-cash items and working capital (balance sheet movements).

The operating cash from profits is…

Retained Profit $80,000

Non-cash items $50,000

Total Profit $130,000

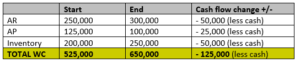

Then we have balance sheet movements in working capital (WC) including:

If you increase AR during the profit period (assume one year), that EATS cash because it’s taking customers longer to pay you.

If you increase AP during the profit period, that GENERATES cash because you are paying suppliers later.

If you increase inventory during the profit period, that also EATS cash because you are spending money to build inventory which hasn’t yet been sold.

So let’s look at the balance sheet for both the start and end of the profit period:

Therefore, total operating cash flow is:

Profit $130,000

Working Capital ($125,000)

Operating CF $5,000

That $80K of retained profit only generated $5K in actual cash flow. The rest was used to invest in working capital.

Next, we have investing cash flow.

This has two components: Cash spent on capital expenditure for the business, such as equipment, furniture, etc.…

And cash received from the sale of assets that are no longer core to the business.

Let’s assume Super Inc. purchased a new machine at a cost of $25K and paid cash. It also sold an old machine for $5K.

Thus, investing cash flow is negative $20K.

The $5K in operating cash flow has gone negative because a new machine was purchased at a net cost of $20K.

So even before the financing of the business, cash flow is MINUS $15K!

Finally, we have financing cash. That is bank or other asset-financing, including equity investments by new or existing shareholders.

Assume Super Inc. didn’t raise any debt or equity financing in the profit period, nor did it repay any of those capital sums. So financing cash flow is $0.

Super Inc.’s free cash flow (FCF) is therefore…

Operating Cash Flow $5,000

Investing Cash Flow ($20,000)

Financing Cash Flow $0

Free Cash Flow ($15,000)

Even though this business was profitable, it LOST CASH over the profit period.

Clearly, Super Inc. isn’t so super at managing it’s working capital, which is the main reason for the cash erosion.

Let’s look at what it could do to improve that.

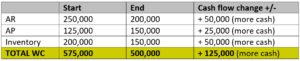

Assume the $130K operating profit is the same but it fixed it’s working capital.

With AR, it reduced the number of days for the average customer to pay.

With AP, it increased the number of days to pay suppliers.

And with inventory, it moved it quicker through the business so had less held on the balance sheet.

So let’s looking at the working capital now:

Now, let’s look at how that impacts FCF:

Operating cash flow is now…

From Profit $130,000

From WC $125,000

Operating CF $255,000

Operating CF $255,000

Investing CF ($20,000)

Financing CF $0

FCF $235,000

That’s a WHOPPING $250K swing in cash flow just by better managing their working capital.

So, profit isn’t what matters…

Because while you can’t spend your PROFIT, you CAN spend your CASH.

Until next time, bye for now.