The world of dealmaking is FILLED with acronyms.

We’ve got:

The list goes on.

Well, here’s another one for you today: ABL.

ABL is an acronym you’re going to want to know. It involves money… specifically financing.

ABL is asset-based lending (or asset-based loan).

When you are closing a deal, these are the financing sources typically available to you:

Without an SBA 7(a) loan, ABL typically forms part of any LBO deal — it involves the use of the business’s assets to finance the deal.

The buyer offers up the assets to a financier. They loan the business money secured by those assets. The buyer then uses the cash from the loan to make a closing payment to the seller. (Or the buyer can use this payment to boost working capital, pay for deal fees or closing costs, or even take a small fee for themselves.)

Within ABL, there are several key assets we can leverage:

It’s also possible in some instances to use intellectual property (IP) to finance a deal (especially if it’s in tech), but this is more complex than we need to get in to right now.

Each asset being used as security for an ABL has a different loan-to-value (L2V) ratio. This is because if the business defaults on its repayment terms, the financier will want to seize the asset and sell it quickly, usually within 30 days.

Here are the typical financing L2V ratios…

Accounts Receivable

AR typically has an L2V ratio of 80%, although it can depend on the specific deal. This is based on three factors:

Some sectors — construction for example — can result in lower L2Vs due to the contractual nature of when jobs get invoiced and paid.

Inventory

Inventory financing has an average L2V ratio of 30% to 50%. This is based on two factors…

Why?

Because if the deal goes south and the financier needs to sell the inventory to get its money back, it can legally enter YOUR premises looking for its inventory, but it can’t storm the gates of the Amazon distribution center.

Fixed Assets

There are two ways t finance fixed assets — and both typically give you a 50% L2V ratio.

The 50% is based on the current depreciated value of the asset, NOT the original purchase price of the equipment.

If a business has overly depreciated its assets, you may find the current value is higher than the depreciated balance sheet value.

The first method to finance fixed assets is to secure financing against them. The asset stays in the asset column of the business’s balance sheet, and the funding raised sits in the liability column until it’s repaid, typically over a five-year amortization term.

The other is a sale and leaseback, where you sell the asset to a third-party financier who leases it back to you.

The asset comes off the balance sheet because you sold it. But it physically remains in your business since you have leased the rights to use it.

The financier then charges you a monthly fee at a typical 50% L2V, again over a five-year term.

This method is more tax efficient since the total cost of the new equipment lease is counted as overhead on your income statement and is therefore tax-deductible.

Real Estate

Finally we have real estate. It works in exactly the same way as fixed assets except that the L2V ratios are higher. Why?

Because real estate typically appreciates in value, while fixed assets (equipment, trucks, etc.) depreciate in value. L2V on real estate is in the 70% to 80% range.

Financiers will want independent valuations on both fixed assets and real estate. There is typically a fee for this, but it can be rolled into the closing costs.

With AR and inventory financing, the financier just uses the accounting information for real-time valuations (since AR and inventory changes minute by minute as inventory comes in, goes out, and invoices are issued, paid, etc.)

Let’s look at a quick example…

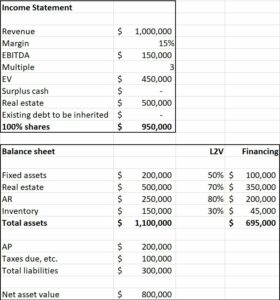

Simple business: $1M revenue at 15% margin generating $150K in profit.

At a 3X multiple, the enterprise value (EV) is $450K. There’s no surplus cash or existing non-working-capital debt to assume, though the business does own a $500K piece of real estate.

So the total deal value is $450K + $500K = $950K.

Looking at all the assets on the balance sheet and applying the average L2Vs we just reviewed, the financing available on this deal would be around $695K.

Assuming you held back $95K for closing costs, a working capital infusion, etc., this would generate a $600K closing payment for the seller.

The remaining $350K could then be paid for via seller financing, potentially even an earn-out.

So that’s ABL — how it works and how you can use it in your deals if they don’t qualify for SBA 7(a) or CBILS-backed loans.

Until next time, bye for now.