Last week, I recorded another episode of James Altucher’s podcast. Obviously, a lot has changed since I was on his show previously.

James and I riffed on the state of small businesses right now and the attitude of business owners when it comes to selling – especially in the current climate.

A little over a month ago, I wrote about the importance of a REFRAME – shifting my expectations and focusing on only the things I can control.

I’ve also written about how the current COVID crisis could create opportunities for you to save lives – by giving highly distressed sellers a safe pair of hands to take over their business.

Today, I want to follow up with some additional insights and a very powerful metaphor…

Let’s start with the metaphor.

As you know, in addition to my crazy reading schedule, I enjoy watching movies and TV to unwind.

One of my all-time favorite shows – Homeland – just ran its eighth and final season.

I have absolutely LOVED this show since the very first episode aired back in 2011.

If you haven’t watched yet – spoilers ahead.

The show is primarily about terrorism. The key characters are Saul Berenson (a CIA officer who becomes the U.S. national security adviser in Season 8) and Carrie Mathison (a highly capable and often rogue CIA agent who suffers from bipolar disorder).

I was watching an episode this weekend and a massive dealmaking nugget was staring me in the face…

In Season 8, the U.S. is trying to make peace with the Taliban in Afghanistan. Unfortunately, the U.S. president and the president of Afghanistan are both killed when their helicopter crashes.

Everyone thinks the Taliban did it – but they didn’t. It was simple mechanical failure.

Carrie discovers the flight recorder proving this. However, it’s stolen from her by Russian agents.

Saul calls the Russian ambassador to the U.S. and asks him point-blank…

“What’s the price I have to pay to get this back?”

“No money,” replies the ambassador.

“There must be an amount of money that gets it done.”

“No, there isn’t.”

The Russians don’t want cash. They want something else. And Saul doesn’t ask the obvious question: What DO you want?

He wouldn’t be a very good dealmaker.

On the other hand, Carrie (who would be a totally badass dealmaker) goes and finds out what the Russians want…

A certain spy identified and… disposed of. So no money. But something else tangible.

How does this apply to dealmaking?

Because sellers rarely want pure cash.

They want other things…

There are BIG things, more points of principle. And then there are small things.

Let’s look at both.

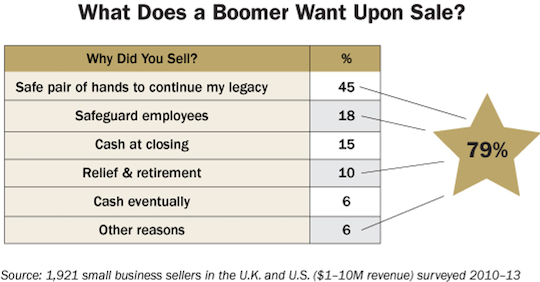

Several years ago, I did an extensive survey online asking business owners what motivated them to sell.

The responses were mind-blowing…

Only 15% of sellers were primarily focused on collecting maximum cash at closing…

Just 6% wanted to maximize cash eventually (that’s where seller financing and earn-outs work so well)…

But the other reasons had NOTHING to do with money.

A safe pair of hands to take the business to the next level… Protecting the legacy the owner had built and grown to cherish… Relief from giving up operational responsibility… A dignified exit to pursue retirement (remember 10,000 baby boomers are retiring every single day in the U.S. and almost 20% own small businesses)…

And there are other reasons – micro reasons – a business owner wants to sell.

Many sellers just don’t want to go into their businesses anymore, but they NEED the monthly cash flow to maintain their standard of living.

Seller financing works perfectly here again.

Pay the seller a monthly amount from the recurring profit, and take care of the closing costs for both you and the seller with a small amount of the surplus cash from within the business.

Boom – there’s the deal.

Once I acquired a media business in California.

The seller was FIXATED on the name of the business and its logo.

I agreed to change neither and that allowed me to pay just $17,500 at closing – from the business – versus $300,000.

That’s a 94% price reduction.

All because I kept the name and the logo.

But that’s what the seller wanted.

I know because I asked – and she told me.

See, your job as a dealmaker is to enter negotiations prepared to listen at least three times MORE than you speak.

When you do speak, ask open-ended questions like…

Asking those questions will reveal golden nuggets of information about the seller’s deepest desires – and you can map your deal around those wants.

In sales, it’s easy. Find out what the customer really wants and then give it to them better than anyone else.

In dealmaking, it’s the same. Find out what the SELLER really wants and then give them a deal structure that delivers that better than anyone else.

Most commercial buyers or competitors don’t care about legacy, safeguarding employees, business names or logos. They all disappear before the ink is dry on the contracts.

When you care about what the seller wants – and make it front and center in your deal – it will steer you away from using cash in 79% of cases.

And in the end, everybody wins.

Until next time, bye for now.

P.S. When you talk to sellers there are three killer questions you must ask that will give you TONS of information about them AND their business. What are they? Watch here to find out.