There’s been lots of chatter in our Facebook groups over the past week or so regarding doing deals in the SaaS sector.

SaaS is an acronym for “Software as a Service.” It’s the equivalent of renting software from a provider on a per user, per month basis, compared with buying the licences upfront, installing them onto your own servers, and paying for maintenance, service and upgrades.

SaaS is everywhere. ClickFunnels is a SaaS business. As is Xero, the online accounting platform.

Amazon Prime, Netflix, LinkedIn Premium, Microsoft 365, WordPress: These are all SaaS businesses.

If most traditional software players are migrating to SaaS models and most smaller players in the market are following, can we buy them using the leveraged buyout (LBO) model?

The short answer is: In some cases, yes.

Say you have defined your deal specification and you want to acquire a small SaaS business. Maybe you’ve even identified some deals.

So far, standard dealmaking rules still apply — this is still about building relationships and understanding seller psychology.

Remember the perfect deal triad? You need:

We’ve established No. 1 already so let’s look at No. 2…

It’s fair to say that the majority of SaaS businesses are owned by younger entrepreneurs. You rarely tend to find retiring baby boomers, so issues like legacy and employee protection are not as dominant.

More likely, you’ll find owners that are burned out. For this sector, that’s our area of focus.

Some entrepreneurs will start a SaaS business, scale it to $100K in monthly recurring revenue (making it a seven-figure business annually) and get bored. They miss the thrill of a startup and would rather sell and move on to something else.

What you will typically find with SaaS businesses is that valuation multiples tend to be higher (e.g., 5X vs. 2X–3X for a brick-and-mortar business) and that you’ll need to pay between 50–75% of the deal consideration at closing.

This makes the deal a good fit for the U.S. government’s Small Business Administration (SBA) 7(a) loan program. Although SaaS businesses don’t typically have assets, as long as you are a U.S. citizen (or partnered with one), demonstrate sector expertise and are looking to acquire a business with robust and growing financials, you should pass the SBA qualification process.

So let’s look at two ways to close a SaaS deal — No. 3 of the perfect deal triad.

Option 1: SBA 7(a) Loan

Let’s take a $1 million SaaS business with a 20% margin, so $200K per year in profit.

At a 5X multiple of profit or EBITDA, that’s a $1 million valuation assuming no real estate, surplus cash or debt in included. So $1 million for 100% of the business.

As the buyer, SBA 7(a) loan criteria require you to kick in a minimum 10% (or $100K). The SBA program will then fund between 70–90%, so for the sake of our example let’s assume 80%, or $800K, of financing.

And say you secure the final 10% with a stand-by seller note that you pay the existing owner once you fully repay the SBA loan or if you sell the business, whichever comes first.

Assuming 5.5% interest and using the SBA loan calculator, this deal will require a $8,682 monthly payment, or $104,184 per year.

The current profit is $200,000 per year. Assuming that translates into cash flow, it’s almost a 2X cover ratio (1.92, to be exact: $200,000/$104,184.)

Even if you didn’t grow the business at all over 10 years, you would still net $96K per year.

Now let’s look at your 10%. You need $100K plus all the deal fees to close the deal, so let’s assume $150K to be really conservative.

If you don’t have access to $150K, you can partner with an angel investor who will buy shares in the business for the money they put in.

On a $1 million valuation, it would be nice if the angel would invest $150K for 15% of the shares, but it doesn’t work like that.

In my experience, the buy-in will be approximately double, i.e., $150K for 30% of the shares. Obviously, this will depend on how hard you negotiate, but budget for 30% in this case.

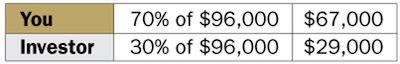

So now you own 70% of a SaaS business and still haven’t invested any of your own money.

Without growth, you would personally collect 70% of the free cash flow AFTER the SBA payment is made.

But because in all likelihood you WILL grow this business, you’ll make multiples of $67K per year.

Option 2: Cash Flow Lend Plus Equity

This will work exactly the same way as the SBA 7(a) loan but over a shorter period and with more dilution, since you will need more equity.

Assume you’re looking at the same deal with a $1 million purchase price and you agree to pay $750K at closing with $250K deferred.

The $750K at closing includes a $500K cash flow lend and a $300K equity loan from an investor (including $50K for closing fees).

For $300K the investor will probably want 50% of the shares in the business.

The $500K cash flow lend will probably have a five-year term. It can be longer than five years but again, let’s be super conservative.

Going back to the loan calculator, your payments would be $9,551 per month (capital + interest), or just shy of $115K per year.

And let’s assume the $250K deferred is paid over five years as well. That’s another $50K per year.

Adding that $50K to the $115K, the total debt service is $165K per year, leaving only $35K per year ($200K – $165K) in free cash flow before growth.

Still, owning 50% of a SaaS business with $35K per year in net cash flow isn’t too shabby.

But when you grow it…

The beauty of SaaS businesses is they can scale quickly.

Say you grow the business from $100K to $250K per month in recurring revenue — you now have a $3 million business. And since operational costs will increase only marginally, you should see an uptick in profit to at least $600K per year, though probably much higher.

So the net free cash flow is now $600K less $165K deal service, or $435K per year. At the 50/50 split with your investor, that is $217.5K for you and $217.5 for them.

Not bad.

Though in both Options 1 and 2 you may need to dilute your ownership in exchange for equity from investors, SaaS deals can definitely be closed using the LBO model to generate both cash flow and long-term wealth for you.

Happy hunting!

Until next time, bye for now.

Carl Allen

Editor and co-founder, Dealmaker Wealth Society

P.S. Module 5 in my Dealmaker CEO online training program goes in depth into the financial analysis and valuation of a deal. Not only that but I give you two very simple proprietary models that will help you value any deal, no matter what the sector! It’s everything you need to know about balance sheets, income statements and profit multiples so you can structure an offer that will give you the MOST bang for someone else’s buck. Get details here.