At Dealmaker Wealth Society we teach you it’s insanely possible to deals with no money down.

But sometimes you need equity to close a deal.

Equity is CASH someone invests into your deal in exchange for becoming your partner. You are essentially sharing ownership of the business.

While many of our students have done deals without external financing by negotiating to pay the seller over time, often the seller wants a closing payment greater than the surplus cash in the business.

That additional capital can come from financing the business’s assets (i.e., accounts receivable, real estate, equipment and/or inventory)… cash flow lending via an SBA 7(a) or traditional bank loan… or raising equity from an outside investor.

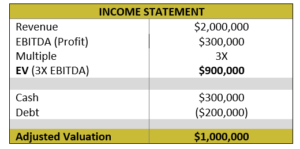

Let’s look at an example deal:

Now, let’s look at the structure of this deal.

Assume the seller agrees to $600K at closing then $400K of seller financing.

If we assume another $50K for fees and other closing costs, we’ll need $650K to close this deal.

We know we have $300K surplus cash, so that’s a good start. But let’s assume it’s an IT business and there are no assets in this deal, just cash flow.

Borrowing $350K as a cash flow lend is roughly 1.2X EBITDA ($300K). Even though that’s a conservative estimate, to secure it the cash flow lender will more than likely want to see equity in the deal.

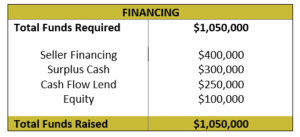

So let’s assume the lender pledges $250K providing $100K of equity goes in.

Our financing list now reads as follows:

Given the relatively small size of the deal, it will not be appealing to a venture capital or private equity firm. Rather, the place to best find an equity investor will be an angel investment network.

You may think that $100K of equity in a $1 million deal means giving away 10% ownership, but it will be more than that.

Since the investor will know you are not personally investing, you may have to give up 20% or 25% of the deal to make it worth their while.

But owning 75% of a profitable business is still GREAT — better than owning 100% of nothing.

Yes, angel investors can be a great source of capital to close a deal. But there’s another, even MORE powerful, benefit.

Angel investors are high net worth individuals that have typically made money by selling a business (or multiple businesses) to generate wealth — either a business they started, or one they acquired then grew.

So not only does partnering with an angel investor give you the capital you need, it ALSO gives you a raft of industry knowledge and experience.

Angels typically invest in sectors they know, understand, are passionate about AND can add massive value to.

The angel can assist you in marketing and business development. CHECK.

The angel can serve on your “board of advisers” and act as a custodian of the business to stop you from doing anything dumb. CHECK.

The angel can plug a critical skill gap you may have in the business like CMO or CFO. CHECK.

The angel can leverage their network to help you grow and manage the business. CHECK.

The angel can provide follow-on capital for bolt-on acquisitions to help you grow your empire. CHECK.

The angel can assist you in the sale of the business empire once you have grown it and decide to retire. CHECK.

There are lots of angel investment networks. There are general networks, industry-specific networks and even location-specific networks.

To find them you can Google “angel investors + [industry]” or “angel investors + [industry] + [location].”

Then partner with them for…

It’s a win-win for you (AND a win for them).

Happy hunting.

Until next time, bye for now.