Yup, I’m a mess.

I badly busted my knee during — a complete severing of the meniscus — my recent 75 Hard challenge.

When I visited my knee doctor on day 62, he told me I would need surgery as soon as the challenge was over.

But on Day 74 (the day before I finished), he called to invite me to take part in a clinical trial for a revolutionary new stem cell therapy.

So my options were:

I went with option two. So far, it’s working and I feel great.

What does all this have to do with dealmaking?

It reminds us there is more than one way to close a deal…

And that the most obvious solution isn’t always the one that gives all parties a win.

Let me explain from a quantitative and qualitative perspective…

Quantitatively, we are looking at the numbers and the structure of the deal i.e., the closing payment, seller financing, term of payments, etc.

Qualitatively, you need to understand in detail what the seller truly wants in the deal. This is also super critical.

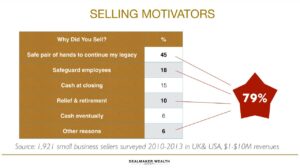

If you have enrolled in one of my training webinars or programs, you will have seen this graphic…

Several years ago, I surveyed nearly 2,000 small business sellers. A whopping 79% did NOT see getting CASH at closing as their number one concern when selling their business.

Other factors came into play, including:

If your offer encompasses some — better yet, all — of these intangible points, you are off to the races.

I once acquired a U.S. media business where I managed to avoid a $300,000 closing payment because I promised to do (and wrote into the contract) these three things as the new owner:

Like knee surgery, there were TWO options:

I went with option two. No brainer.

In addition to not considering the seller’s REAL motives, a big mistake made by rookie dealmakers is to ONLY focus on the multiple of profit to be applied for the valuation.

But this is only one part of the offer. The TERMS of the payments are even more important.

Let’s look at a simple deal example…

Assume you’re looking to purchase a software business with little to no assets where customers pay monthly. The financials are:

Revenue $1,000,000

Profit $100,000

Multiple 2.5X

Valuation $250,000

Option 1

The seller wants $200,000 at closing with $50,000 seller financing. To get $200,000 in cash to close this deal you would either have to sell a ton of equity to an investor (leaving you with a small percentage of ownership…) or go the SBA 7(a) loan route, which would still involve you contributing $25,000 in cash, having solid credit and signing a personal guarantee.

Option 2

You offer $500,000 — a 5X multiple of profit — to buy it because you have a solid plan to grow the business. This overvalues the business by a factor of two, but stay with me…

You could offer $300,000 in guaranteed seller financing payments AND a $200,000 in an earn-out based on higher profits in the future.

So let’s say you offer $60,000 per year for five years in seller financing and an annual $40,000 earn-out as a 50/50 split of all profits greater than $100,000 per year.

The seller gets DOUBLE the price for the business, and you acquire 100% of the business with NO cash out of pocket, NO external financing and NO credit checks.

Would you take Option 1 or Option 2 on this deal?

Option 2, right? No brainer.

Let’s summarize. There are always multiple options to doing anything, especially when it comes to closing deals.

If you are like me, you would elect for stem cells in your knee to save you the time, pain and inconvenience… and you would offer the higher valuation on the software deal.

It’s a win-win…

You don’t have to pay any out of pocket cash or have financing to consider. And the seller gets DOUBLE the value (and cash) for their business.

So think creatively in your deals. Find out what the seller truly wants, map your deal around that…

And give the seller options so you can create the win-win.

Until next time, bye for now.