Almost every year, the President of the United States delivers a “state of the union” address to congress.

It reflects the pulse of what’s happening in the country and how he plans to shift policy moving forward.

This week, I’m doing something similar regarding the state of the dealmaking environment.

I’m going to cover:

Today, we’ll talk about sectors and overall temperature of the dealmaking market.

On Friday, I will get into the financing landscape and what to watch out for if you are doing deals that require external capital infusions via investors, SBA 7(a) loans, asset-based lending, etc.

Though will focus my points primarily on the U.S. and UK markets, the principles apply to all western geographies.

According to the Harvard-based Opportunity Insights Economic Tracker, revenue for U.S. small businesses has fallen 21% on average this year, with the leisure and hospitality sectors hardest hit.

While the global COVID-19 pandemic is the main culprit, many business owners are showing an inability (or unwillingness) to think outside the box and pivot their business models.

“I’m just going to keep doing what I’ve done for the past 20 years,” a manufacturing business owner said to me recently.

That’s dangerous and foolish.

The world has changed — probably for good — with consumer and business behavior along with it.

I can give you tons of examples of business owners who buried their heads in the sand during the spring and got stuck.

I can also give you tons of examples of business owners who adapted and not only survived, but THRIVED (and are still thriving), through COVID:

Obviously, there is something to be said for buying into today’s HOT sectors and emerging areas of opportunity like:

That said, don’t rule out opportunities where you know YOU can pivot the business.

In those cases, go ahead and proceed if you feel confident the business can get back on track with a post-COVID industry resurgence…

Or because of the skills, experience and value-add you bring to the table.

According to my own extensive analysis conducted PRIOR to the pandemic, there are approximately 2.92 million businesses for sale across the U.S., U.K., Canada and Australia.

Yet only 1 in 11 were likely to sell in 12 months.

But after the year we’ve had, seller motivation (and even distress) has increased.

It’s not necessarily that their businesses are failing as much as it is that COVID-19 is the proverbial “straw that broke the camel’s back.”

Think about it. You started a business in the 1970s and survived through all of the major recessions:

Now, you encounter the COVID recession of 2020. This one makes you wonder, “Do I want to keep doing this? How many more punches can I endure?”

The number of businesses for sale will be driven UP by sellers who think NOW is the time to retire and do something else. They are done with recessions.

That’s what I’m seeing in the marketplace, primarily with older sellers of the baby boomer generation. And their businesses are attractive to younger buyers.

BizBuySell.com tells us that the average age of buyer has dipped below 50 for the first time EVER.

A big driver of that is younger professionals who want to be entrepreneurs and work for themselves… but would rather BUY than START their own business.

(I’ve been banging that drum for YEARS and people are finally listening!)

Not only will there be more businesses for sale, but thanks in part to a liquid capital market and low interest rates…

Serious buyers are only going to get more aggressive to capitalize it.

That’s why I maintain this is the best climate for small business acquisition in 50 years…

So if you arm yourself with a business buying system like Dealmaker CEO that gives you access to the skills, tools and capital resources to get deals done, the opportunities are ripe for the taking.

So does this mean closing deals TODAY is happening faster and more frequently?

Not exactly…

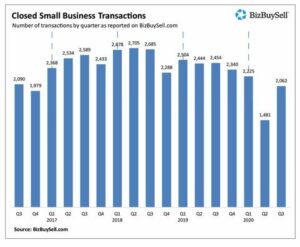

According to the largest U.S. online broker platform BizBuySell.com, closed deal transactions are around the 2017 levels, down 22% from 2019.

Deal closures are similar in the U.K., propped up in part due to CBILS, the COVID-related, government-backed business financing initiative which can be used (in some cases) to buy businesses.

The main reason for the dip in deal closures goes back to the average dip in revenue I mentioned earlier.

Sellers don’t want their sale prices diminished by one bad year, while buyers want to see as much of the 2020 financials as possible for their valuations.

Therefore, buyer due diligence has become increasingly important.

If a business has slumped during the pandemic, there’s a much stronger need to determine if it can come back. The answer to that will obviously have an impact on valuation and the viability of getting a deal done.

Once a deal has been negotiated, the timeframe to close it has gotten longer. According to the International Business Brokers Association, the average time to close a deal (from first contact) is now 8.6 months, up from 6.4 months in 2018.

This has more to do with COVID restrictions on travel rather than buyer and seller psychology.

Despite the economic havoc wreaked on so many small businesses this year, I haven’t seen small business valuation multiples change by that much throughout the pandemic.

The average multiple for most small businesses in the $1 million to $5 million remains under 3X, with technology, healthcare, and a few others still pushing 4X and above.

What has changed is, however, is deal structure.

Buyers should only pay for current and historical performance. If a business has slumped, that will impact the valuation. At a 3X multiple, a $200,000 drop in profits from 2019 to 2020 will have a $600,000 impact on the valuation.

But creative dealmakers are making the difference up through earn-outs. Earn-outs are bonus payments given to sellers based on meeting specific future performance benchmarks.

In our example, if the business got back to historical average profit levels, that would trigger earn-out payments to make up for the reduced valuation at closing.

As Adam and I always say… valuation is important, but deal structure is critical.

It doesn’t matter that much what the valuation is if the business can be paid for over time with seller financing and earn-outs. That way both buyer and seller share the risk and the upside.

If you have a motivated seller, this is a palatable option.

So that’s it for part one of my State of the Dealmaking Nation.

In part two on Friday, I will tell you what I’m seeing in the financing market and how you can take full advantage of it.

Until then, bye for now.