I hope you’ve gotten a lot out of Deal Execution week thus far.

Today I’m capping it off by talking about possibly the most important thing YOU as the BUYER need to do during this phase.

There’s a common theme that I ABSOLUTELY know to be true…

Revenue is vanity. Profit is sanity. But cash flow is reality.

Cash flow is measured over a certain period— a year, a quarter, a month, even a week. It’s the difference between what cash you end up with versus what you started with.

In other words, for all the revenue your business makes, how much of that cash actually sticks to your fingers.

Cash IN the business is primarily revenue generated by customers paying their invoices (or, in the case of a B2C or an online subscription business, payments taken at the time of sale).

However, Cash OUT has many forms. Suppliers, employees, overhead, expenses, capital expenditure (CapEx), taxes, loan interest and capital repayments all drain cash.

Understanding cash flow is absolutely CRITICAL to the closing of a deal… and to the operation and growth of the business afterward.

In our flagship Dealmaker CEO training system, we provide a simple model to estimate what the cash flow will be in the business versus the amount of financing you need to take on to close the deal. We call this the cover ratio.

At the time you’re vetting the deal and making an offer, this is a close approximation. That allows you to move faster and make offers on multiple deals versus spending all of your time on the exact numbers, which will inevitably slow you down.

But once you’re in the deal execution stage, it’s time to get precise and fine-tune the cash flows.

Cash flow is impacted by four main factors:

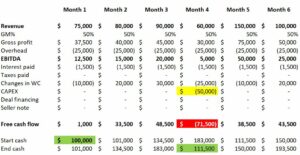

Let’s look at an example. Say you are acquiring this business:

Revenue = $1 million

Gross Profit = $500,000 (50% margin)

Overhead = $300,000

EBITDA = $200,000 (20% margin)

Multiple = 2.5X

Enterprise Value (EV) = $500,000.

Let’s assume there are no adjustments for surplus cash, real estate and liabilities, so you are buying the business for $500K.

And say you agree to a $250K closing payment and a $250K seller note for $50K per year over five years.

You raise $300K of financing to also cover closing costs, working capital top-up, etc. Worst-case scenario, it’s a cash flow lend that will also repayable over five years.

Now assume you plan to grow the business by 20%. Here’s how the cash flows would be forecasted over the 12-month period post-closing…

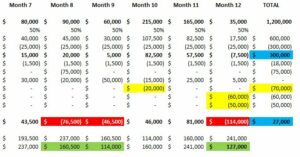

Say the business starts with $100K of cash (green). You can see from the forecast that revenue is seasonal and there are some lumpy uses of cash — namely CapEx, and the servicing of the acquisition loan and seller financing in month 12 (yellow).

Overall, the business generates $27K of free cash flow over the 12-month period from EBITDA of $300K (blue). That is, $27K left over after interest and taxes paid, CapEx, and debt servicing.

You can see in Months 4, 8, 9 and 12 the business actually LOSES money (red). Those months do not generate the most revenue, yet the cash out payments erode cash in those months.

This is fine… providing you harvested and rolled over the cash build from the earlier months. It’s important to never drop below the minimum cash balance we set at $100K, the cash balance immediately after acquisition.

This is an exercise you MUST do DURING the deal execution phase so that you can time the cash flows — driven primarily by servicing the acquisition loan and seller financing — in order to negotiate with the lender and seller on when to make those payments.

Not to mention, you now also know the low revenue months. You can formulate a plan to smooth out the revenue curve, work with customers to bring forward the orders and run special promotions to boost sales in the slow months.

This work is ESSENTIAL for not only closing the deal, but it gives you part of the blueprint for running and growing the business once you own it.

Don’t do deals without it.

Until next time, bye for now.