In my recent State of the Dealmaking Nation: Part 1, I explained how earn-outs are being more commonly used by buyers and sellers to bridge valuation gaps.

However, earn-outs have been in force for as long as I’ve been a dealmaker.

One of my first deals involved the sale of an engineering company to a very large U.S. conglomerate. I was advising the buyer. There was a valuation gap of almost $50 million and we got there through earn-outs.

Earn-outs are bonus payments made by the buyer to the seller based on future activity of the business. They can be triggered by:

This year, some business owners have decided it’s time to sell because they don’t want to trade through the uncertain times caused by the pandemic.

But if 2020 performance dipped, a buyer is going to lower the valuation based on current (not historical) performance.

Let’s run through an example…

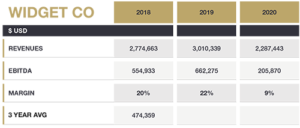

Say Widget Co. has the following income statement:

And let’s assume there are no adjustments to be made for real estate, surplus cash or inheriting existing liabilities.

Just looking at the financial performance, 2018 was solid and 2019 even better, with a 22% profit margin on healthy, growing revenue.

Then the pandemic hit.

This year’s revenue will be $2.3 million (worse than 2018) and margin will drop to 9%.

The current profit is only $206K.

If the years were reversed and performance was trending right to left in the chart above, you would use a three-year average of EBITDA ($474K) to do your valuation.

But because profits have declined dramatically this year, you may just want to use the current $206K.

Assuming you’re applying a buying multiple of 3X, had the pandemic never hit the valuation might have been as high as $1.4 million (3 x $474K).

But since it did, a buyer might feel the valuation is now worth 3X only this year’s profits, or $618K.

$618K to $1.4 million is a big range. How do you plug a gap of $805K?

Assume the $618K is simple to finance. There’s $500K in financing for a closing payment, leaving $118K in seller financing which you agree to pay over three years at $39K per year.

But the seller wants more for their years of hard work building the business.

Let’s see how an earn-out plugs the gap.

Remember, earn-outs are BONUS payments. My rule of thumb is to run them off the profit numbers and at least share 50/50 in the upside.

First, you need to establish a benchmark profit number, which can be calculated as:

Current Profit + Debt Service on Financing + Seller Financing

Assume you’ll have a debt service on the acquisition financing of $50K per year.

The benchmark would be:

Current Profit = $205,870

Seller Finance = $39,203

Debt Service = $50,000

Total = $295,073

That’s your baseline — it’s the minimum amount you need to keep profits flat while meeting the obligations of the deal.

In other words, an earn-out will NOT be triggered below that level, and we’ll negotiate a 50/50 split of any profit ABOVE that point.

Remember, the valuation gap is $805K.

For a 50/50 profit split where the seller gets $805K, the business would need to do an incremental $1.6 million of profit over a forecast period.

That’s a BIG ask, but let’s see how we could do it…

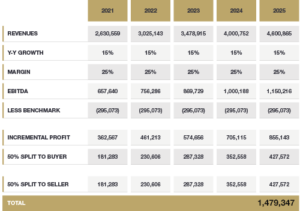

Your plan would obviously involve growing the business. Let’s assume a 5-year forecast with an average 25% margin and 15% year-on-year revenue growth.

Within two years, the business would be back on track with pre-pandemic performance. Great!

But what if that performance continues for another three years? What happens then?

Profits explode from $206K in 2020 to $1.2 million in 2025. If you were to split the incremental profit 50/50 in each of those five years, the seller would get a total earn-out of $1.5 million, putting you WAY over the valuation gap.

You may want to cap the forecast period at three or four years, or when the $805K valuation gap is paid.

However, since the seller can’t control your expenses, they may push back on an earn-out tied to a profit metric. They may instead want you to tie the earn-out to a revenue growth target since that’s harder to manipulate.

So, you would set a revenue benchmark — say $2.5 million in this case— and pay a 50/50 split on a 25% increase beyond that.

You can also tie an earn-out to gross margin, but the rules are the same.

So, that’s an earn-out. It’s a bonus string of payments that can bridge valuation gaps while being made contingent on increasing performance of the business.

The number one key to agreeing on an earn-out rule is convincing the seller you are the safe, trusted pair of hands to take the business forward.

The seller has to know, like and trust you enough to have high confidence you can drive the necessary business growth.

After all, the valuation gap depends on it.

I will see you soon with another WTF.

Until then, bye for now.