If you own a small business and want to grow it, you can…

Continue to hustle day in and day out, generating more leads, converting them into sales, even developing new products and services to sell to existing customers (or the new ones you are looking to target)…

But the smarter, faster, CHEAPER way is to BUY another business, combine it with what you already have and benefit from the amazing synergies.

Like your ability to cross-sell products and services from both businesses to each other’s customers and the cost savings from combining operations (economies of scale in purchasing, reduced duplicate overheads, etc.).

Now, I know you totally GET this, but the objection I frequently hear is I don’t have time.

So today I’m going to show you the power of human leverage, which starts with how you think.

You need to think of yourself as an owner-investor, not an owner-operator. Someone who works ON the business versus IN the business on a daily basis.

Recently, I wrote about the FIVE things you need to focus on as an owner-investor if growth is your goal.

You may need to get yourself into that mindset BEFORE you start looking for deals to bolt into your existing business.

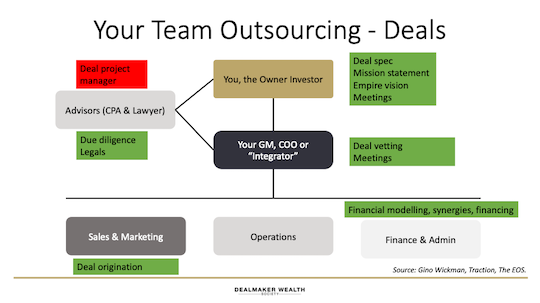

Here’s a simple framework I use in all my businesses that I learned from the Entrepreneurial Operating System (EOS) discussed in the bestselling books Traction and Get a Grip by Gino Wickman.

It positions every business as a three-legged stool…

As the owner-investor, you are on top – the visionary, the strategist. You only work on needle-moving stuff (the five things I mentioned earlier).

Reporting to you is your general manager (GM) or COO, the person who runs the day to day.

If you can, promote from within. If you don’t have this person in your business, go find them. Use your network.

Reporting to the GM are the three business lines: sales and marketing, operations and finance and administration.

Each department is accountable for their own results, which feed up to your GM, who delivers the results laid down in YOUR strategic plan.

That takes care of operating your business, freeing you up to do deals.

Now, as the dealmaker in your business, you don’t need to do all the work here either.

You can leverage your team to do some of the heavy lifting – in addition to their work operating the business. You can also solicit help from external advisers.

Let me show you…

As the owner-investor, you need to define the deal specification. What type of business do you want to buy?

Perhaps a competitor so you can double down on your market share…

Or a business in your supply chain. Maybe you are an engineering firm and you decide to buy your largest raw materials supplier to increase your profit margins.

Or you want to enter a complementary market. Think a hardscaping business acquiring a landscaping business or a plumbing contractor buying an electrical contractor.

You can seek advice from your GM and three department heads, but ultimately, it’s your decision. YOU own the strategy for your business.

Once you know the type of business you want to buy, you can start originating deal opportunities. Your sales and marketing team have the closest links to the market and can help with generating deal flow.

They can also do the heavy lifting liaising with brokers, leveraging their (and your) networks and contacting target businesses via direct approach.

Once you have deals to vet, your team can do the analysis. Will the business move the needle? Does it have what you need?

When you have narrowed down the candidates to a manageable number, you will probably hold the seller meetings, but your GM can also do some of them – particularly the first meetings.

Once you have some strong deals you like, you can bring your financial team into the deal to create the valuation and deal structure as well as identify potential funding.

Your financial team can also dig into the numbers to identify money to be saved from cost synergies and work with the sales and marketing team to identify likely cross-selling opportunities.

Once you make an offer on a business – you should always do this as the owner – you can bring in external advisers to close the deal for you.

Your CPA can handle all the financial due diligence.

Your lawyer can handle the legal due diligence… create the purchase agreement… and advise on the best way to own the new entity (asset deal, equity deal, ownership classification structure, etc.).

Your GM and sales team can handle commercial due diligence, also called a GSWOT analysis:

This enables you to have an action plan ready to execute as soon as you close the deal.

Now you know how to structure your existing business to free you up to close deals – and how to leverage both your internal resources and external advisers to get the majority of the heavy lifting done.

You are the deal quarterback – you call the shots.

Make the right play and acquire a new business to rapidly scale your revenue, cash flow and net worth.

Until next time, bye for now.

Carl Allen

Editor and co-founder, Dealmaker Wealth Society

P.S. Building a badass deal team starts with having a strong network. Join the Dealmaker Insiders group and meet dealmakers and business owners just like you. Start making connections, ask questions and get access to exclusive content. And it’s totally free to join – click here to be approved.