Engineering businesses generally make for excellent (and fairly common) leveraged buyout (LBO) deals.

Why? They are/have:

- Business-to-business (B2B)

- Typically owned by older, retiring owners who value legacy and safeguarding

- Rapid growth opportunities that have typically been held back presenting a strong opportunity to accelerate the business

- Asset rich (great for LBO financing)

- In an industry with relatively low barriers to entry

- Widely available workforce almost everywhere

- No barriers to long-term scale

- Favored by the SBA 7(a) loan program, subject to the usual criteria.

Let’s look at a case study so you can see how to structure an engineering LBO deal.

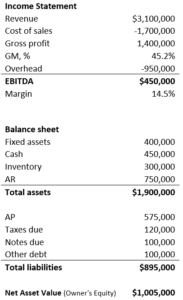

Imagine these are the financial statements for the business you were targeting:

This is a healthy business.

Any engineering business with a gross margin of 45% and an EBITDA margin of 14.5% is strong.

Normally, to properly value the business, you would look at the financial performance over several years. But for simplicity, let’s value and structure the deal on the latest numbers only.

With $450K of EBITDA, this engineering business is worth approximately a 3X multiple, making the enterprise value (EV) is $1.35 million (450K x 3).

If there was real estate in this deal, you would add it to the EV calculation. But let’s assume there isn’t and move on to the cash and debt.

You always want to see a minimum of one month’s revenue in CASH on the balance sheet (i.e. $3.1M/12, or $258K).

In this case, there’s $450K on the balance sheet — the $192K of “extra” cash is considered “surplus” and needs to be added to the EV.

Great news is, we can use the surplus to fund the deal. Bingo.

Now let’s look at the debts we will be incurring.

We will assume the AP and taxes due, and deduct the $200K of other debt and notes due from the EV.

Thus, the REVISED valuation for 100% of the shares in the business is:

Original EV $1,350,000

+ Surplus Cash $192,000

– Debt ($200,000)

NEW EV (100% Equity) $1,342,000

Since the cash and debt basically cancel each other out, the EV stays roughly the same.

Now, let’s look at your possible deal structure.

The total financing available will be somewhere around $1.1 million. You have:

- $192K of surplus cash

- $400K of fixed assets that will net about $200K (50%) in financing

- $750K of AR that will net about $600K (80%) in financing

- $300K of inventory that will net about $120K (40%) in financing

For this deal, I wouldn’t bother financing the inventory — you don’t need it.

I would just finance the fixed assets and AR.

(You can finance the inventory later if you want to add even more cash for growth.)

Thus, financing available at closing is:

Surplus Cash $192,000

AR Financing $600,000

Fixed Asset Financing $200,000

TOTAL CASH $992,000

Reserve $92K for closing costs and a fee for yourself and just offer $900K as a closing payment.

Going back to the EV we calculated earlier, I would offer up to $1.3 million for this engineering business:

- $900K at closing

- $400K seller financing over 4 years ($100K per year)

When it comes to repaying the loans, you should be more than fine.

The AR will be financed as a revolving line of credit — meaning you’ll need to service the interest but won’t have to repay the capital.

The $200K fixed asset financing will probably have a five-year payback period, or $40K per year.

Add conservatively another $100K per year for interest and other debt payments, and the total cash OUT of the business annually will be:

Seller Financing $100,000

Fixed Asset Financing $40,000

Other Debt Service $100,000

Total Debt Service $240,000

The cover ratio — the amount of cash generated by the business in a year divided by the amount of cash needed to service the deal — is greater than 1.5 (i.e. $450K/$240K = 1.9), which is what you want to see.

When we buy a business using other people’s money (the technical term for this is a leveraged buyout, or LBO), there are typically three parts to the offer:

- Closing payment.

- Seller financing (also includes earn-outs or bonus payments based on performance).

- Debt inherited.

For this negotiation, I’d start with 75% ($657K) of the $900K you could offer, plus $400K of seller financing.

Offer 2 would be the full $900K plus the $400K of seller financing.

If you need to sweeten the deal further, you could extend seller financing to five years by adding another $100K to the deal…

Propose an earn-out — bonus payments made on meeting agreed upon financial targets —to increase the total deal consideration …

Leave the seller a small, retained piece of equity…

Or mix and match any of the above.

So, that’s an example of how to structure an engineering LBO deal.

Be sure to also check out the analysis I recently did on doing deals in the SaaS sector.

Until next time, bye for now.